Community banks are described as those with $10 billion or less in assets. They provide banking services to local communities. The importance of digitalization was proven during the lockdown era imposed to stop the spread of COVID-19. It emphasised the risks of falling behind in financial technology and innovation.

Community banks face a great challenge that threatens their very existence. The world is going through one of the biggest revolutions and many are not even aware of it. Everyone, including Gen-X, Millennials, and especially Gen-Z is now tech-savvy. Gen-Z population was and is being born into tech.

According to a survey, people between the ages of 25 and 34 are more likely to use an online bank, and people ages 35 to 44 are also in favor of online banks. Reasons being;

- They prefer a banking experience that is accessible from the comfort of their homes.

- With the rising debt consciousness, more and more Americans are finding new tools to manage their money and these tools are readily available on the go - financial wellness, online payments, early wage access, etc.

To grow and become better in this age, community banks must prepare for the future which is now.

Why are community banks holding back digitally?

“Customer satisfaction among credit union members in the US declined more than 2 percentage points last year to 86.3%, per a report by PYMNTS and PSCU. The share of those satisfied with their digital and online bank rose from 82.8% to 84.8%”

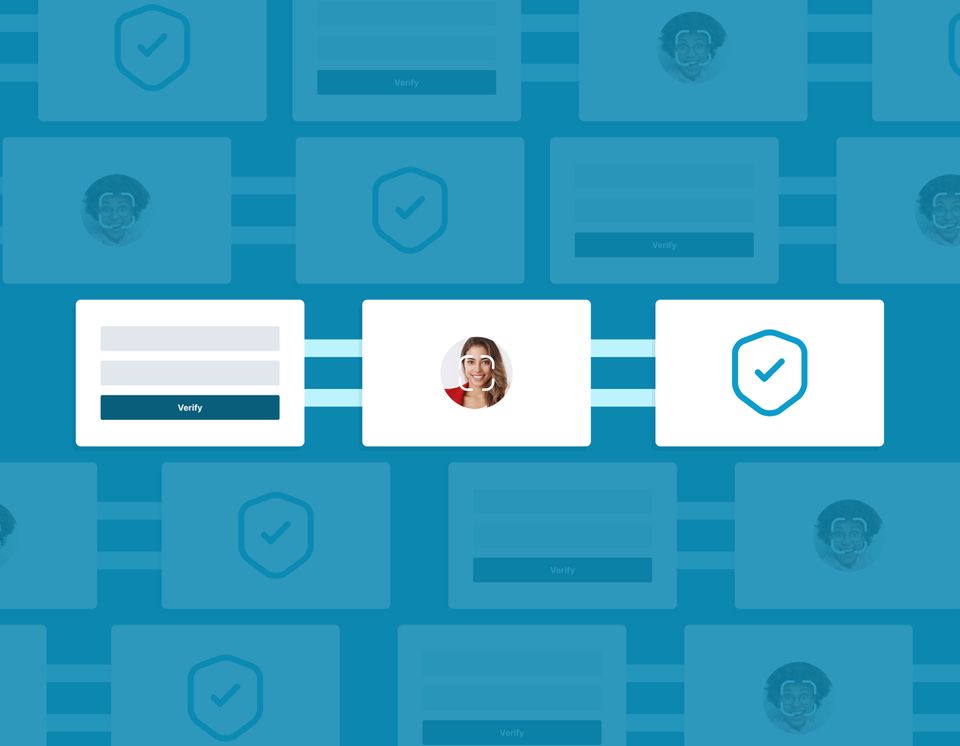

Identity Verification

Onboarding new members, managing risk and delivering core services are important in today’s online economy. Identity verification stands at the very beginning of that journey as part of Know Your Customer process (KYC).

KYC is important for account opening. Traditionally, KYC was performed in-person at the bank. With online fraud attempts going up by 25%, lack of digital identity verification has delayed the digital transformation plans of many Financial Institutions.

Identity verification plays a big role in the financial services industry. It helps to establish trust and security between businesses and customers. Community banks can leverage AI-based identity verification tools to boost member onboarding experience.

Application program interfaces (APIs), for example, have powerful benefits for community banks. You can easily transfer data and synchronize your bank's system with identity verification services. For instance, Kysync from Deposits.inc. It can be integrated into legacy or modern banking processes to make identity verification a seamless experience.

Risk Aversion

When it comes to risk, innovation, and new investments, community banks often prefer to do things "the way we've always done things.”

Banks are reluctant to upgrade existing systems. This could be a result of fear of making their current systems obsolete. Comfort with the status quo makes them suspicious of new technologies.

Due to the high risks involved in financial institutions, they can be skeptical about changing or modifying existing systems. They might not be open to new approaches from new players in tech that help make their digital transformation easier.

Financial Implications

Most community banks lack the resources to examine, test, and invest in expensive fintech systems. They do not have the cost advantages that larger banks do. Setup charges might be discouraging because they are on the high end.

Technology is never constant; it develops and evolves. Community banks might fear investing in a new technology that could become obsolete in a few years is a waste of money.

It’s time to go Digital

Digitalization is changing how people transact and do business on a day-to-day basis. Advancements in banking technology are continuing to influence services around the world. The increasing demand for digital banking is transforming how the banking industry operates.

The influence of technology will continue to launch banking into a digitalized future. Customers are no longer interested in long processes. They want the quickest and efficient services. They get frustrated when it takes more than a few minutes to get their account opened and fully functional. FinTechs have shown that verifying a customer’s identity can take only a few minutes and so they expect the same from community banks. Digital identity verification methods such as biometric verification, face recognition and digital ID document verification can help community banks verify the identity of a person online.

Community banks must be aware that they may be dealing with an aging population. Older customers are more likely to continue with the banks with which they have had a long relationship, regardless of how good the services are. They feel at ease with both cash and paper transactions. Only a small percentage of the older generation uses digital technology or a combination of the two.

The younger generation, on the other hand, has grown up with digital systems. They don't seem to want to bank with community banks that aren't fully digitalized. This means that if community banks do not find a method to appeal to the younger generation, they risk becoming redundant as the older population retires. Community banks should be aware that there are numerous ways to service both existing and new customers.

Customers are now thinking more of convenience when it comes to customer satisfaction. Some years back, a smiling face behind a counter can make a customer satisfied with the bank’s services. This is not so for today's customers. Customers are more interested in services that are simple yet efficient and do not need them to visit a physical building. Physical branches and buildings are now a serious turn-off for most customers. Community banks need to make it possible to please their convenience-oriented customers as physical branches can only be functional for customers that prefer in-person services.

How Community Banks can go Digital

To remain sustainable, community banks must offer valuable digital offerings. They don’t have to stop being who they are but rather think of ways to keep their customers and reach out to the unbanked. They should use the wealth of customer data they already have to better serve their clients’ needs. Customers in every sector today are more informed and forthright. They are willing to switch loyalties in a split second to get what they want. So how can community banks be relevant in this new age?

It starts with the right platform.

We know that both commercial and retail customers are underserved and are often using multiple apps to piece together the functionality they want from their banks. We also know that the unbanked are looking for a low cost digital banking experience that presents them with support rather than friction.

We know that they want an experience that's comparable to what they could get from folks like Chime, Square, or Brex but backed by a local banker for human to human support — COVID-19 has only accelerated this demand.

Deposits was born to bridge the gap between brand capabilities and consumer expectations.

More than just APIs, Deposits.inc offers ready-made and fully customizable digital payments and banking for Web, Android, & iOS platforms with the most advanced features to create better, more prosperous relationships with business and retail customers.

We do this at less than half of what it currently costs brands today, while simultaneously bringing new players into the market to meet the needs of the underbanked and underserved. Think of it as a turnkey “bank or fintech in a box” that can be attached to any brand, community bank or credit union.

Our solution is completely pre-configured, fully customizable, and highly automated by design. We eliminate the need for extensive integrations so that it can be implemented in weeks, not months or years.

Our Advice

Going digital in banking is the future and the way forward. Community banks that embrace this future early enough stand the best chance of surviving the now and next generation of bank customers.