KYC is becoming more strict across companies, especially financial institutions and it is driving a lot of their business decisions. It is therefore important we know the key processes that enable financial institutions to know their customer, stay compliant and still give their customers a great customer experience.

KYC is an acronym that translates to "Know Your Customer". By definition is a set of processes carried out by companies including financial institutions to verify the identity of their customers both individual and corporate. This is done in the first stage of the relationship with a customer. They ensure their customers are acting legally before accounts are opened for them. KYC process protects financial institutions from doing business with individuals or organisations involved in illegal activity like money laundering, terrorist financing or corruption. KYC is at the heart of customer identification and onboarding for any financial institution. Whether it is account opening, lending, insurance, securities trading, risk management and compliance, KYC is always first.

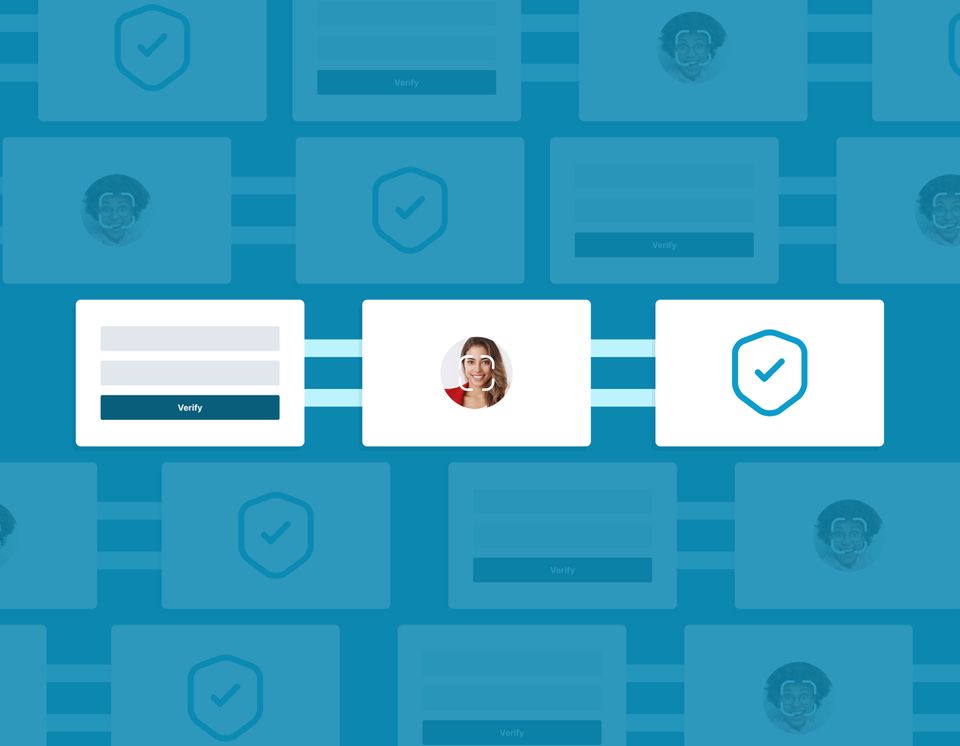

KYC Process

The KYC process begins when a customer is asked to provide basic information in order to open an account or onboard the customer. Financial institutions cannot escape the mandatory KYC process of verifying customers. According to Title III of the USA Patriot Act, financial institutions have the responsibility of complying with two areas of KYC: the Customer Identification Program (CIP) and Customer Due Diligence (CDD).

Customer Identification Program (CIP) is the first step in the KYC process. It involves collecting basic information about a customer or organization who wants to do business with a financial institution. This information includes; name, address, date of birth, and identification card containing identification number. The types of ID verification required can vary from bank to bank, but frequently government-issued ID such as a passport, social security card, or driver’s license are acceptable. The information provided is then examined and verified. The purpose of CIP is to make sure that the individual or organization performing financial transactions is verified. This is very important to financial institutions as it will check money laundering, terrorist financing and other illegal criminal activities.

Customer Due Diligence (CDD) involves collating information about your customers to predict what kind of transactions a customer might carry out and assess the risk involved in these transactions. The only way financial institutions can accurately report on suspicious activity is through CDD. For due diligence, financial institutions may request to know the origin of the funds of their customers, occupation, purpose of opening an account, financial information, company name, explanation of business, and so on.

Why is the KYC process so Important?

One of the most common ways people launder money, finance terrorism or carry out other illegal activities is by opening anonymous accounts. KYC is an important tool as it looks after the financial bodies and keeps illegal activities in check. With KYC, financial institutions have the right to check the legal status of that entity. This legal right also includes cross-checking customers’ operating addresses and verifying the identities of authorized signatories. The KYC process also requires to know the nature of employment and/or business carried out by the customer which is useful in verifying the authenticity of an individual and/or company. This helps to know the primary source of a customer’s funds and ensures the money the customer invests is not for any money laundering related purpose. Generally KYC prevents undue participation in terrorism and money laundering activities, it reduces exposure to fraud by verifying that clients are who they claim they are.

Traditional KYC

Some few years ago KYC was only in the form of an in-person verification. The customers have to share physical, self-attested copies of their documents when accounts need to be opened for them. It was paper-based that required a physical connection with the customer for documentation and signing. The need for physical ID and document verification made the account opening process for new customers complicated, tiring and time-consuming. It was also costly for both the customer and financial institution. This always created poor customer experiences and abandonment of the entire process. It resulted in lots of friction for the customer. Traditional KYC relies on a combination of papers and spreadsheets. This increases the risks associated with data or documents, it could be misplaced or misreported and this translates into high error rates, as it is said, even the most thorough spreadsheet requires human interpretation.

KYC Now

With restrictions on movement, social distancing, and even the closing down of some physical banking branches caused by the pandemic, the process of the physical face-to-face identification of customers became difficult. This has affected financial institutions as many still rely heavily on hard copy documentation in order to carry out KYC processes. This difficulty has created opportunities for innovative thinking and digital transformation in the KYC market.

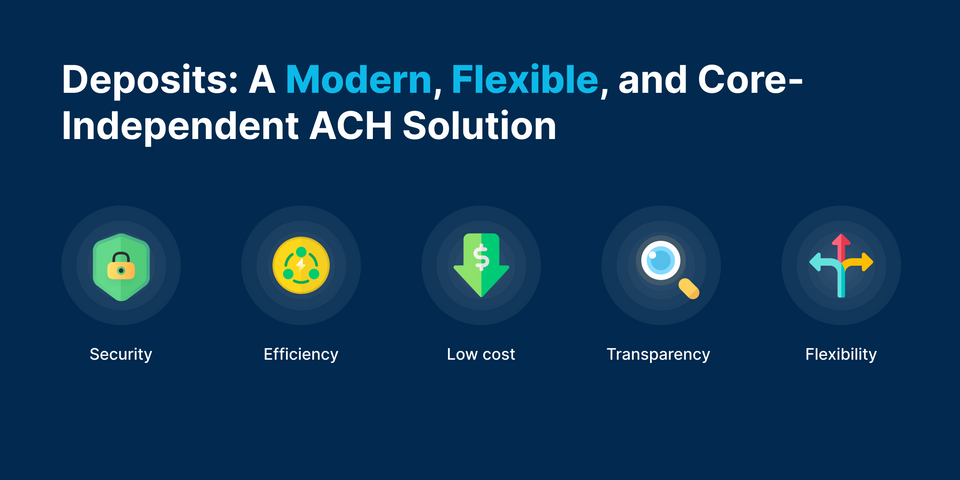

Financial institutions that are keeping up with technology have replaced branch account opening with online account opening. Physical documents are now replaced with digital IDs and technology. This allows customers to open and fully set up their accounts online without having to step foot in a physical bank. It also allows customers to present their identification documents virtually and digital KYC is carried out. Digital KYC process is the digital and remote means of verifying the identity of customers, making sure they are who they claim to be. Weeks needed for completion when using the traditional KYC process become seconds with lower cost in an optimized process. Digital account opening like what is done in deposits.inc can happen in a few seconds. It is all about achieving a delicate balance of verifying customer identity while not making the process cumbersome. The major advantage of digital KYC is that it is far less time-consuming and cumbersome than traditional KYC and it still maintains adherence to regulations and rules.

KYC now involves adopting a quick, simple but yet secured and compliant customer on-boarding process in order to deliver a seamless user experience to consumers. Take deposits.inc's KYsync as an example of digital KYC that ensures optimal security while delivering the best user experience. We have certain features that make our digital KYC solution very efficient for financial institutions.

Features of Digital KYC

There are features that every digital KYC solution that is used for digital account opening should be characterized with. An identity check in recent times involves digital verification of a customer’s name, date of birth, address, nationality, and so on. The use of multiple technologies in order to counter fraud, comply with regulations and reduce manual effort involved in physical verification is thus necessary. These technological features make digital account opening process possible and efficient.

Optical Character Recognition (OCR)

Optical Character Recognition (OCR) is a technology that helps you recognize text inside images, photos, and scanned documents. This advanced technology is used to convert almost any image having text either printed, typed, or handwritten into machine-readable text. OCR scans identity documents such as National ID, driving license and passport, and converts the scanned documents into files easily read by the machines with very high accuracy. The information obtained by scanning the identity documents can be used to auto fill the account opening form. This makes the KYC process instantaneous, reliable and time efficient.

Face Recognition and Liveness Check

Liveness detection for face recognition is the ability of a computer system to detect if the person in front of the camera is alive and real and if the customer is the person he or she claims to be. It also detects if that customer is acting by his or her own free will, or if someone else is trying to commit fraud by showing a picture or a video of that customer. Face recognition uses Artificial Intelligence and Deep Learning algorithms to match the consumer’s video selfie with the photo shown in the identity document and do real-time consumer verification and authentication. Face recognition and liveness check speeds up the digital KYC process, while ensuring compliance and security.

Geo-tagging

Geotagging is the process of attaching geographic coordinates to photos, videos, websites, text messages, and QR codes based on the location of a mobile device. During a video KYC, consumer’s geographic i.e. longitude and latitude coordinates and timestamp are embedded in the video, enabling the bank to confirm the customer's location. For geo-tagging on mobile phones, consumers have to turn on the location service and allow the banking app to access his or her location. Geotags also reveal where individuals are when engaging with a website. This is also a feature KYsync possess, making address verification easy.

ID Forgery Detection

Forged ID documents done by experienced frauds are hard to detect by human eyes. ID Forgery Detection, which enables the detection of all common types of forged or altered ID documents by using precise machine-learning models, can solve such problems effectively. Machine learning based algorithms are used to scrutinize the identity documents and images for authenticity. With an ID forgery detection solution like with KYsync, it takes a little to no time to figure out if a document is real or has been tampered with and where the errors lie.

Anti-Money Laundering (AML) screening

AML screening is one of the methods used for risk assessment of an existing or potential customer of a financial institution under AML guidelines. This helps to ensure that customers are not present in any of the sanctions lists, banned or wanted lists. The information shared by the customer, such as full name and date of birth, is checked against AML data and sanction list. Then with the help of an AML screening solution, like KYsync, the name of the person is screened against all sanctions and watch lists, to ensure that they are not listed in any. Performing screening of your customers is the main element of the AML compliance program.

Our Final Words

Financial institutions do not have to compromise on compliance and regulations because they want their customers to have a seamless experience while opening a digital account. They could offer new customers a faster digital account opening process without the need for physical appointments. Existing customers could also have access to new products and services by updating their KYC information in just a few minutes. With KYsync from deposits.inc, financial institutions can make the KYC and the entire digital account opening process very easy and still efficient while saving costs.