Executive Summary

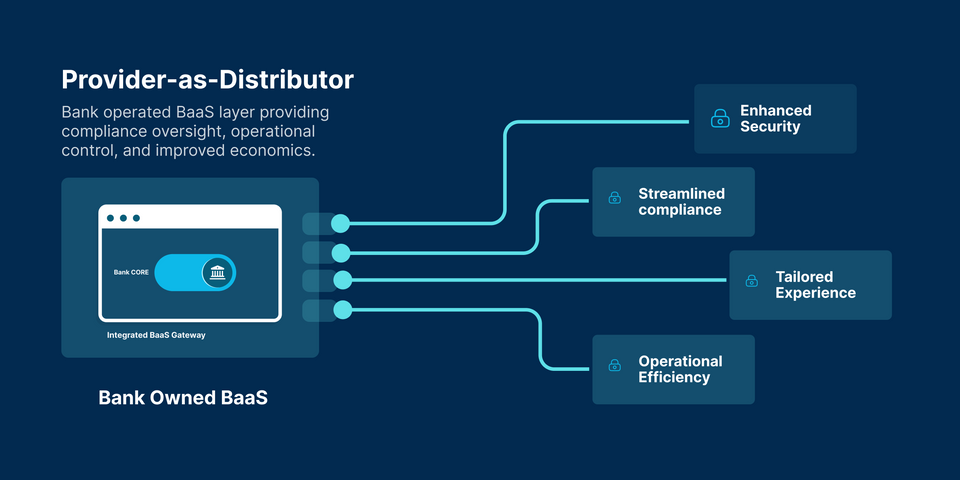

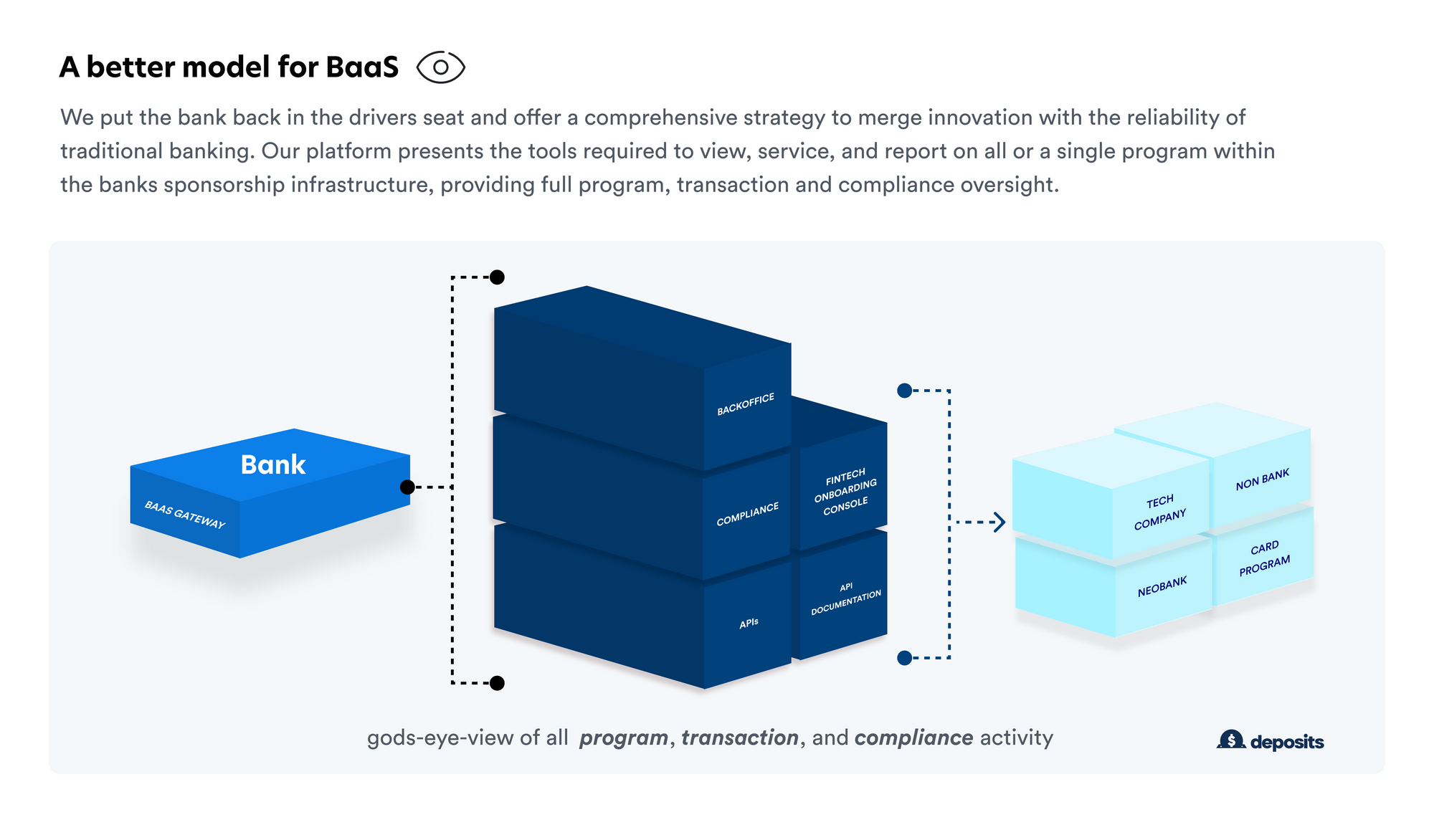

The Banking-as-a-Service (BaaS) landscape is undergoing significant transformation, spurred by regulatory shifts and technological advancements. This article explores the rise of the Provider-as-Distributor model, which allows banks to internalize key functionalities of BaaS, thereby regaining operational control and enabling better compliance. Financial institutions adopting this model can expect to achieve streamlined regulatory alignment, enhanced client interactions, and improved security posture.

Background

Banking-as-a-service is a partnership model where a financial institution leverages its bank charter to allow one or more non-bank companies to offer financial products directly to consumers or businesses. As this framework gains prominence, it raises important questions about regulatory compliance and system integrity.

The Current Landscape

BaaS is becoming ubiquitous, as non-banks embed financial services into their experience.

- Dan Kimerling, founder and managing partner at Deciens Capital, regards BaaS and third-party distribution of banking services as "a critical evolution" and "the future of financial services."

- BaaS is likened the shift to the migration to cloud computing, which drastically lowered the cost and complexity of launching new products and services based on shared infrastructure.

Banks That Have Embraced BaaS And Embedded Finance Are Generating Higher Returns

Data from Andreessen Horowitz further suggests that banks adopting BaaS strategies experience return on equity at 2-3 times above-market rates.

- Financial services providers can save up to 95 percent of a typical customer acquisition cost, from a range of $100 to $200 to between $5 to $35, according to a report from Oliver Wyman

- BaaS an incredibly cost-effective distribution strategy, as illustrated by the return on equity (ROE) and return on assets (ROA) achieved by the 30 or so U.S. banks currently leading the space.

- Banking-as-a-service is expected to grow 15% each year to be valued at nearly $66 billion by 2030.

Regulatory Focus: Navigating a Labyrinth

Regulatory bodies are emphasizing that compliance can't be offloaded, necessitating closer collaboration between banks, BaaS providers, and fintech.

- Banks are seeking alternatives to bypass the middleman and benefit from an economic model more in their favor.

- First wave BaaS has its limitations and can be seen as risky based on recent consent decrees by regulators, who have indicated that compliance cannot be offloaded and handled by anyone other than chartered institutions.

- There is a growing trend of bank owned BaaS, where banks either buy or partner with a BaaS middleware provider. Fifth Third’s recent acquisition of BaaS provider Rize is evidence of this fact. — Industry and bank leaders have indicated that Rize's technology, rather than its customer base, was the key driver for acquisition.

- The Federal Reserve’s recent creation of the Novel Activities Supervision Program is both an acknowledgement of this innovative model and a move to standardize the oversight of financial institutions (FIs) who capitalize on their BaaS rights.

A Reorientation in BaaS Strategy: Provider-as-Distributor Paradigm Shift

Overview:

Putting banks back in the drivers seat — the Provider-as-Distributor model advocates for a internalization of BaaS functionalities. It suggests a departure from an over-reliance on external collaborators and instead, promotes the consolidation of key BaaS components ranging from bank charters to underwriting within a singular organizational framework.

- Full Transparency: Banks can maintain full transparency into customer accounts and activities.

- Operational Control: Internalization allows banks to manage their own service providers.

- Balanced Economics: This approach bypasses the middleman, leading to a more bank-favorable economic model.

Bank-Controlled BaaS in the Cloud: A Leap Forward

The adoption of cloud technology from providers like Deposits has supercharged the Provider-as-Distributor model:

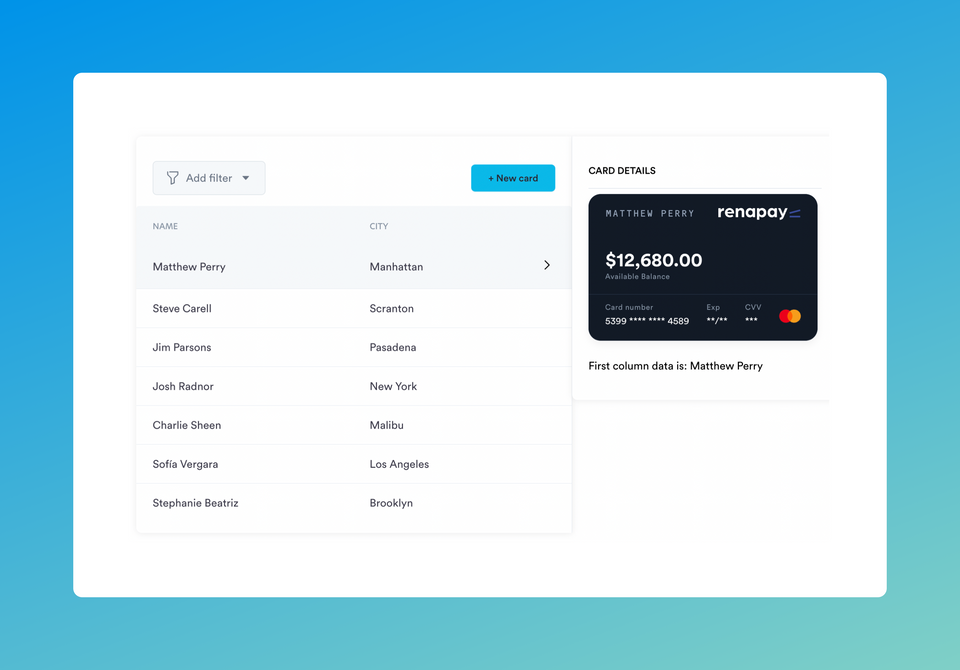

- Complete Ownership: Owning the customer relationship, data, and compliance mechanisms is now easier than ever.

- Tech Transformation with Deposits: Deposits provides the technology and tools needed for banks to evolve into tech banks, empowering them to embed fintech services into their existing applications and offer Baas APIs to fintechs and new partners.

- Choice and Flexibility: The Deposits platform grants banks the freedom to select their features, fintech partners, and processors, giving them complete ownership of their ecosystem.

- Differentiation: Empower banks to launch targeted card programs and niche payments solutions, setting them apart from the competition and capturing new market opportunities.

Make Your Bank a Tech Bank

Transform Your Financial Institution into a Tech-Forward Bank. With Deposits FIs:

- Own The Ecosystem: Customize and select specific features, fintech partnerships, and payment processors that best fit your institution's objectives, allowing for a tailored approach to your customers and partners. Leverage intelligent routing, rules, and limits for specialized customer segments, or utilize multi-tenant architecture to segregate various embedded finance programs.

- Offer Partner-Friendly Solutions: Extend your banking services by embedding them into your fintech and brand partners' applications.

- Embed Fintech Seamlessly: Integrate a wide range of fintech services into your applications.

Strategic Advantages

- Facilitated Regulatory Alignment: Streamlined internal processes improve compliance.

- Customized Client Interactions: An integrated operational landscape enables highly personalized client experiences.

- Augmented Security Posture: A centralized operation diminishes risks and vulnerabilities associated with third-party affiliations.

Charting the Course: A Roadmap for Transition

To succeed in this rapidly evolving landscape, organizations need a calibrated blend of innovation, regulatory adherence, and robust security measures. The Provider-as-Distributor model serves as a nuanced approach to meeting these requirements.

Transition Strategies

- Revitalize Existing Channels: Stand out in a saturated market by elevating your service offerings.

- Adopt a Modular Tech Architecture: Consider parallel or 'side-car' core systems.

- Empower Fintech and Brand Collaborations: Create an enabling environment to foster innovation.

Conclusion

BaaS has reached a fork in the road, and financial institutions must decide their path. The Provider-as-Distributor model or Bank-Controlled-BaaS, supported by platforms like Deposits, offers a way to align with regulatory requirements, say yes to new fintech programs, and build revenue streams that propel their core business forward.

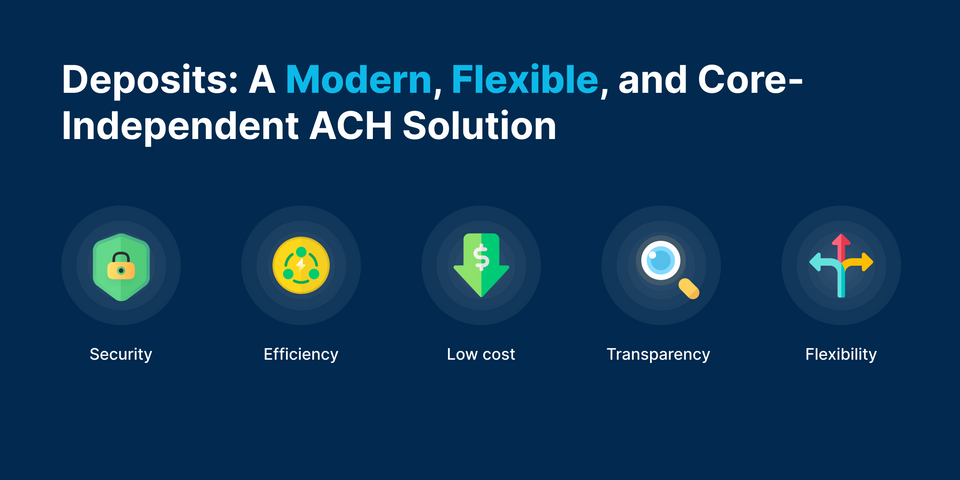

Deposits readily integrates to a bank’s existing core, saving the bank time and money replacing the core and allowing it to focus on innovation like delivering embedded finance or distributing new products. With our Deposits, your bank can expand its reach, increase revenue, and better meet the needs of your customers.

Deposits offers more than a BaaS chassis or gateway, the Deposits platform is a full suite of integrated tools engineered to fast-track market entry and meet the demands of the connected economy:

- Product Development Platform: Expedite the design and launch of financial products with our streamlined toolkit.

- Digital Sandbox: Evaluate your innovative solutions in a secure, flexible sandbox environment specifically built for industries under strict regulatory constraints.

- Side-Car/Shadow Ledger: Optimize your financial transactions using our cryptographically secure double-entry accounting ledger, allowing for impeccable record-keeping.

- Digital Experience Accelerators: Utilize our pre-built frameworks as launchpads to quickly bring tailored online/mobile banking, payment, lending, or account-opening experiences to market.

- Comprehensive APIs: Leverage our modular low-code components, white-label solutions, UI kits, and SDKs to integrate both front-end and back-end services for an unparalleled customer experience.

- Expanded Connectivity: Extend your institution's capabilities through our wide network of core banking systems, payment rails, and fintech marketplace partners.

Future Outlook

As the BaaS ecosystem matures, we can expect the Provider-as-Distributor model to gain further traction, particularly among larger financial institutions equipped to handle the technological and operational complexities. Emerging platforms could further streamline internal processes, making compliance and security easier to manage. The focus will likely shift from not just providing financial services but doing so in the most efficient, transparent, and customer-centric way possible.

Get in touch

If your institution is looking to harness the advantages of BaaS while mitigating risks, the time to act is now. Evaluate your internal capabilities, consult regulatory experts, and consider transitioning to the Provider-as-Distributor model to stay ahead of the curve.

For a more in-depth discussion on this transition, connect with us to explore how Deposits can facilitate your journey toward becoming a tech-forward bank.

Your success is not just our objective; it is our commitment.