Executive Summary

This article presents the key challenges with the current ACH system and introduces Deposits, an innovative bank-owned-BaaS solution that offers greater efficiency, control, and flexibility with confidence. In the era of digital transformation, financial institutions (FIs) face the challenge of the limitations of the Automated Clearing House (ACH), a decades-old payment standard. Although ACH has been a reliable workhorse for bulk payments like paychecks and utility bills, the traditional ways of interfacing with ACH, either via core vendors or manual entry, are rife with pitfalls such as high costs, lack of transparency, and operational inefficiency. As fintech partners increasingly demand modern, agile solutions, FIs require an approach that not only connects to ACH but also streamlines the entire payment process.

The Pain Points of Traditional ACH Systems

ACH via Core Vendors

Financial Institutions often employ core vendors like Fiserv or FIS for conducting ACH transactions. These solutions offer reliable service but come with their own set of challenges:

- Lack of Transparency: Transactions are often completed without providing any detailed information, leaving FIs in the dark about the processes involved.

- Lack of Control: The rigid structure and pre-formatted data limit the flexibility FIs have over their ACH transactions, making them dependent on their core vendors.

ACH via Manual Entry

Alternatively, FIs can upload files manually through Federal Reserve offerings like FedLine Advantage or FedLine Web. While more accessible, this method is:

- Time-consuming: Staff must engage in repetitive logging into systems to handle ACH files, consuming significant time and resources.

- Risky: The manual nature of this approach exposes FIs to human errors, which can lead to financial loss and damage to reputation.

Demand for Modern Solutions by Fintech Partners

Fintech companies, leading the charge in innovative financial solutions, require modern ACH integrations. The pressure for FIs to upgrade their traditional systems is high; failing to do so risks obsolescence.

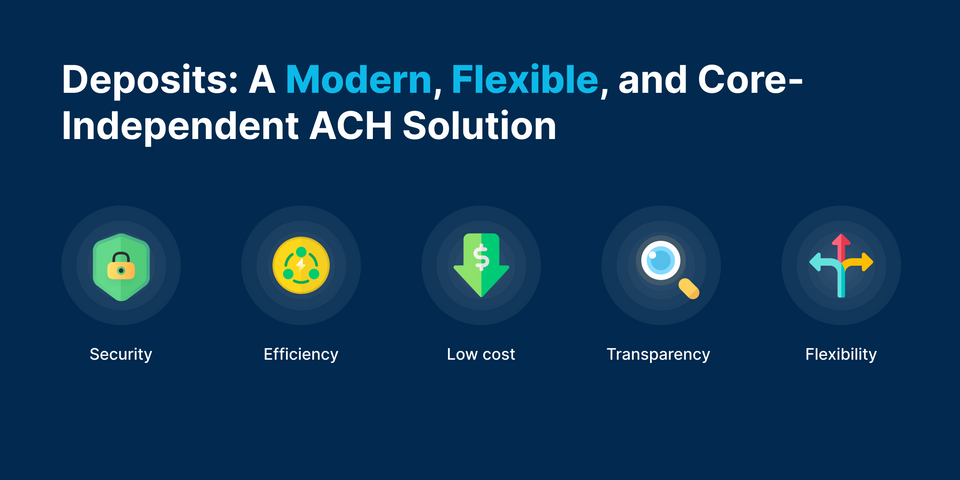

Deposits: A Modern, Flexible, and Core-Independent ACH Solution

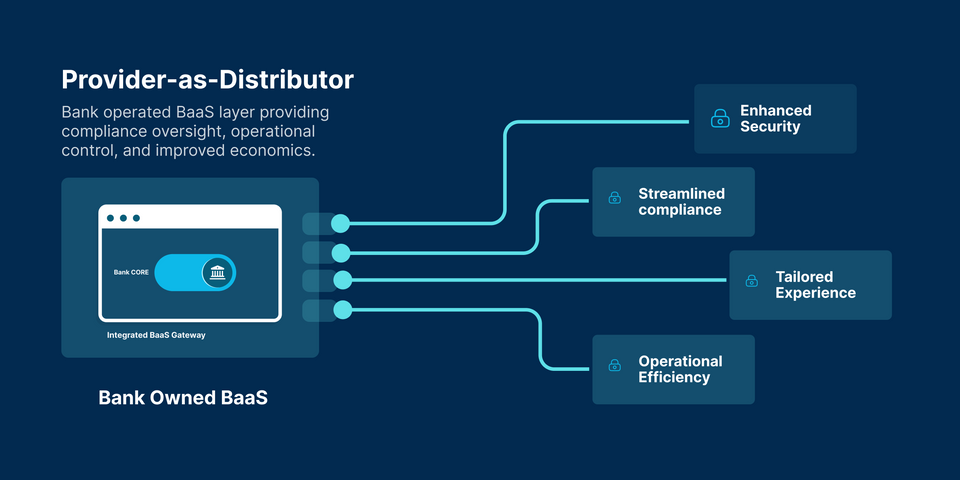

Deposits leverages Open Banking API technology to bridge the gap between various financial systems, automating the ACH payment process efficiently. It allows FIs to maintain control while ensuring compliance and security.

- Efficiency: By automating the ACH transaction process, Deposits significantly reduces time spent on error handling and exception cases.

- Transparency and Control: Deposits validates each ACH file for compliance and performs OFAC checks, providing FIs the much-needed transparency and control over transactions.

- Modern Integration: Deposits offers an API-based connection, meeting the demands of fintech partners and ensuring future-proof, scalable solutions.

Conclusion

To stay competitive, FIs must move beyond legacy ACH systems that are manual, costly, and rigid. Deposits offers an alternative that is not only efficient but also aligns with the expectations of modern fintech partnerships. To learn more about how Deposits can help your financial institution modernize its payment systems, engage with our team of experts today.