Our Mission

To level the playing field with money online through low-code and node FinTech that enables anyone to launch, scale, and manage digital banking and payments for their community.

Our Vision

To use the power of consumers working together to power the banks that serve them.

What We Do

We do for financial brands what Shopify did for retail brands.

Demystifying Banking

- Help anyone to launch compliant digital banking and payments.

- Do you have a COMMUNITY?

- Leverage the best FinTech tools to launch your community's bank... even from your mobile phone. No code required.

Leveling the Playing Field

- Create a competitive advantage.

- For community Banks or Credit Unions

- Save costs, broaden your reach and attract next-gen clients. The growth you're looking for in a branch you will get with the Deposits.inc platform. Up your game with future-proof FinTech, acquire clients, increase originations and grow faster than ever before.

Streamline Operations

- Evolve from patched-up tools and band-aid solutions.

- Go Live with our user-friendly Back Office.

- Manage product suites, client accounts, and view the health of your programs in one easy-to-use platform, plus powerful tools to inform your growth strategy and APIs & SDKs that promote product engagement and customer loyalty.

Why it matters

People

- Communities in need of a financial(tech)partner

- People care where their money goes. Our platform allows them to keep their money in their preferred communities while supporting their causes, values, banks, and credit unions... a $250b revenue opportunity.

Community Banks and Credit Unions

- Understanding your users' problems through data

- Save cost, broaden your reach and attract next-generation clients. The growth you're looking for in a branch you will get with the Deposits.inc platform.

- Level up your Fintech, acquire clients and stay compliant.

Developers and Affiliates

- Marketplace (+APIs) for all things money

- With Deposits, you can launch a FinTech program or distribute your apps in our marketplace by leveraging our 3rd party licenses, certifications, compliance, microservices, and API infrastructure.

What you get

A digital banking that beats expectations, a marketplace for all things money, better financial experiences distributed through online communities, employer groups, community banks, and credit unions.

We provide the best place for your people to save, pay, invest and earn.

We own our stack.

We've re-invented banking from scratch.

Wow factor built right in!

We focused on how customers interacted with money online and built a streamlined system with cutting edge CX, so you don't have to.

Product Differentiation & Competitive Advantage

- Building our end-to-end suite of BaaS primitives delivers full features and pricing control.

- We bring the ability to re-invent small and medium FIs from outside of the core banking platform through open banking interoperability.

- We have a unique payments capability and an smb banking suite that provides invoicing, payments, etc., directly from the end user's bank account.

- We have a full-service affiliate marketplace platform that will accompany our workplace fintech offering, including health and wellness.

- We bring an authentic, compelling brand story combined with vast potential growth opportunities.

Risk/Fraud Mitigation

Our Advanced AI suite keeps us compliant and customers safe. Guides are available in our developer docs and also licensed as openAPIs under the KYSync sub-brand

Product features

Back Office

Easy to use and packed with powerful tools that help you drive growth and manage your day-to-day.

For Brands: We've got you covered if you've got a fresh idea, a community to serve, or even if you're just looking for a new way to make money.

For FIs: Get the growth you're looking for in a branch with our branded digital banking experiences. It even works with your core!

One Click Payments

- Pay with Bank or Card

- Secure Payment Tokenization.

- Identity verification built-in

- Mobile-first experience

- Integrated payment processing

- International payments

- Password-less Login

SMB Banking

- Bill payments and vendor coordination.

- Send Invoices from your account

- Domestic transfers and international wires

- Create one or more Virtual Debit Cards

- Schedule one-time or recurring payments in advance

- Team Roles and Access Control

- Business checking account

- Send and receive ACH transfers, checks*, or wire

KYSync

- Identity verification

- Document verification

- Email verification

- Watchlists Screening

- Liveliness detection

- Proof of address

- Phone and Email Verification

- Admin Backoffice

Mobile Banking

- 55,000+ fee-free ATMs worldwide within the Allpoint Network

- Direct Deposit

- Free P2P payments

- Money Visa Debit Card

- Money Virtual Card

- FDIC-insured deposits

Rapid growth

With one click, we can re-route the destination of payroll funds and enroll users into apps, bank accounts, products, and services For 1 person or 1 million.

What’s Next?

Focus on Innovation

Deliver new products and advice to serve our partners better.

Proprietary technology platform allows for a faster, lower-cost product innovation cycle.

Increase Value

Improve our users' financial well-being.

Deliver differentiated value to members while producing strong revenue growth and profitability.

| Key Verticals | Client Pain Points | Our Solutions |

|---|---|---|

| Communities and Brands | (a) Looking to use fintech as a differentiator in their market (b) Looking for growth w/ young adults in a mobile-first platform |

Embedded financial services expanding consumer engagement, creating new revenue streams. |

| Employers PEOs Staffing Companies |

(a) Unstable, unbanked and underbanked workforce. (b) High turnover, need for employee retention incentives, new revenue streams. (c) Rising healthcare costs, lack of pricing predictability. (d) Need for innovative healthcare solutions, voluntary benefits. |

(a) Out of cycle payroll administration. (b) Earned wage access for staff. (c) Benefits marketplace and administration. (d) HSA and wellness marketplace. (e) EAP financial literacy offerings. (f) Product engagement that creates new revenue. |

| Developers | Need for no code and low code solutions for embedded finance, instant go-to-market applications. | One-stop shop for embedded finance, banking relationships, and open APIs available a la carte with low hurdles to launch. |

| Small and Medium FIs | (a) Outdated technology (b) Shrinking market share (c) Waning customer loyalty (d) New, innovative market entrants |

(a) Better user interface and experience. (b) Get the growth you're looking for in a branch from our platform. (c) Consumer engagement tools, SMB feature sets for invoicing and payment. |

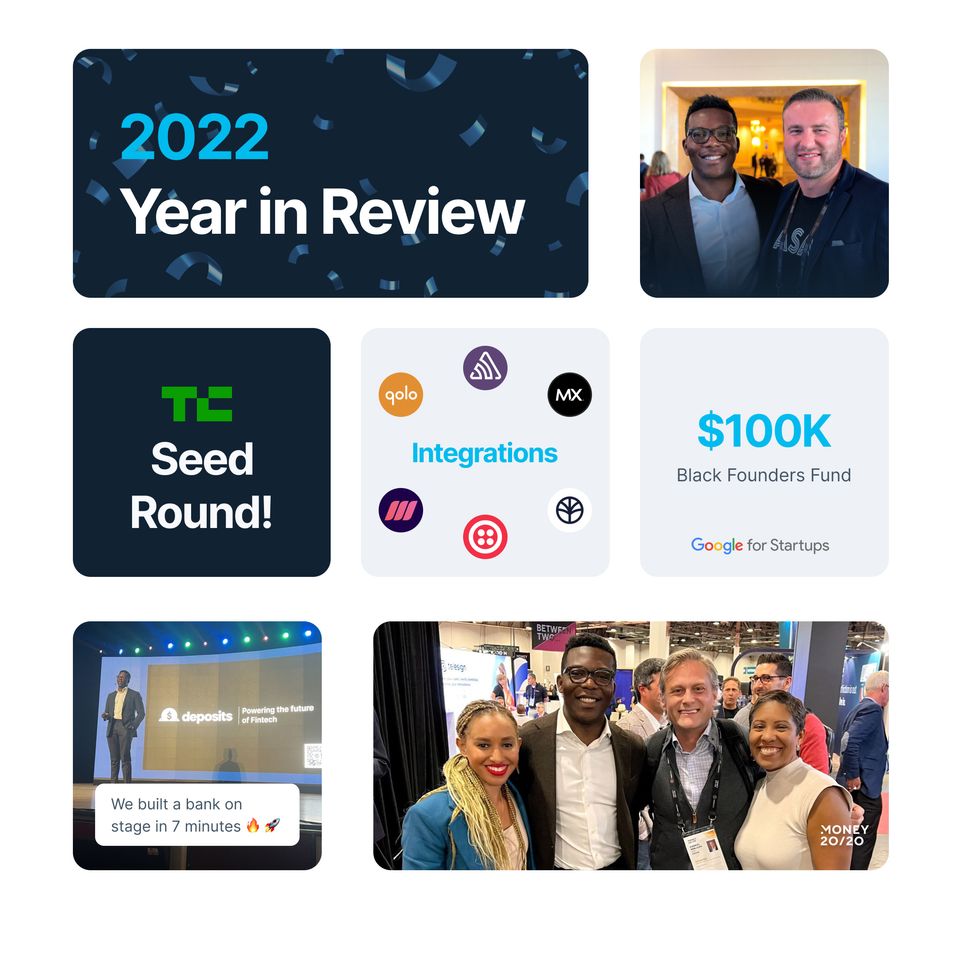

Growth through Better Experiences - Joseph Akintolayo, Founder & CEO

Deposits sits at the convergence of software, banking, and payments. We enable anyone, including banks, brands, and businesses, to deliver the best experiences in money and financial services. Our partners have reduced costs, increased revenue, and accelerated the pace of financial innovation and inclusion.