We’re excited to share some of the features that shipped with the Deposits MoneyKit this year and also let you in on its roadmap for the next two quarters.

First off, what is MoneyKIT?

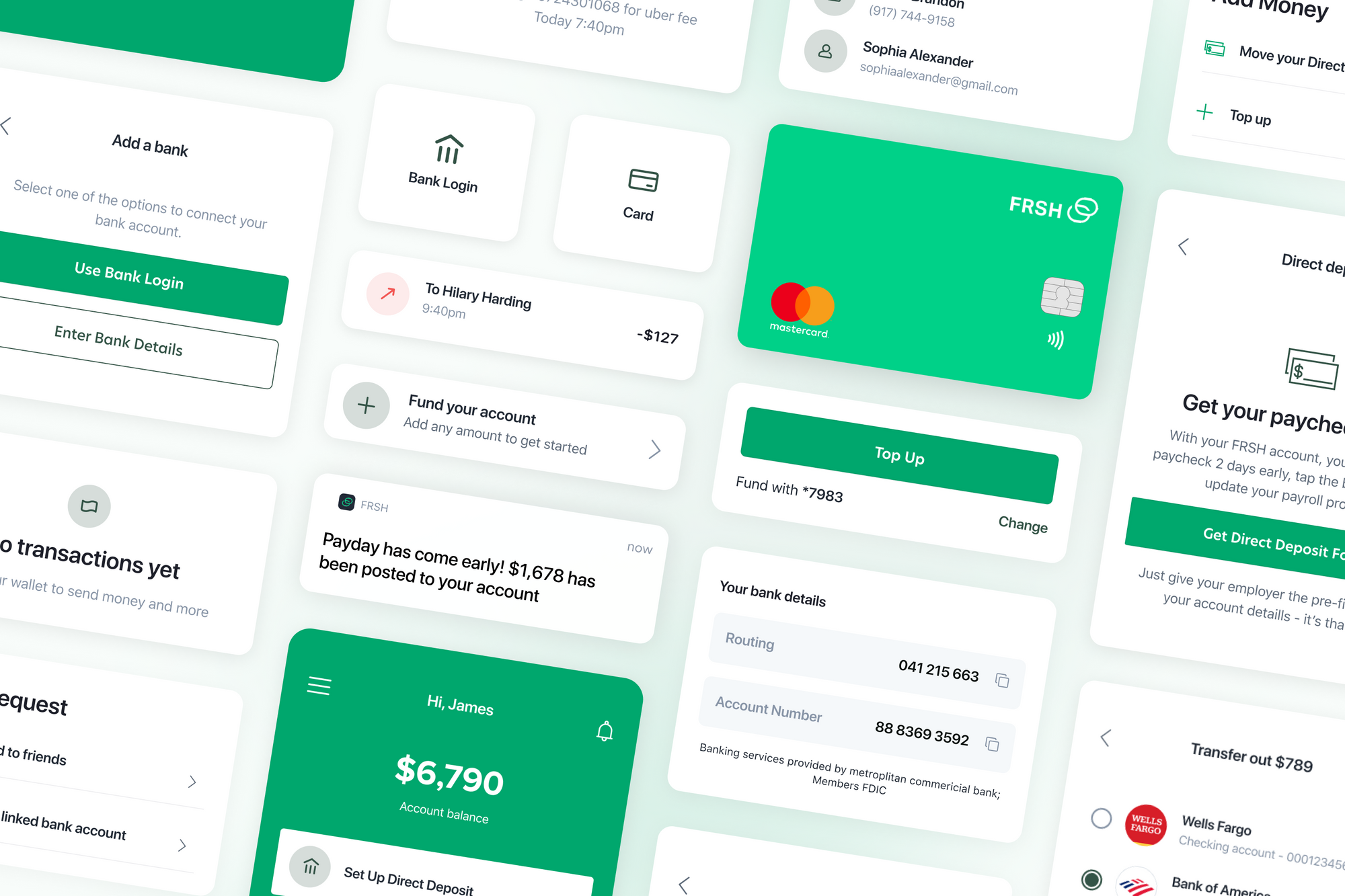

MoneyKit is a cloud-based real-time digital banking solution that enables you to launch new services or embed white labeled financial products into your existing applications and product offerings. Financial institutions and non-banking brands can use MoneyKit to launch mobile money experiences with the same ease as launching a website.

Using moneyKit, brands can offer a mobile banking experiences with features like personal financial managementshared accounts and kids banking, mobile payments, card management, virtual cards, bill pay, rewards programs, and P2P payments. Your users/cohort get access to all the payment methods - Virtual and physical debit cards, Apple Pay, Direct Deposits, and 55,000+ ATM locations.

With modern features for better money experiences - set personal card pin, instantly freeze and unfreeze card, real-time transaction notifications, credit builder, automatic savings, and many more. Everything is modular, this is one of the many benefits of building on Deposit.

You decide when new features from the kit become available to your users, and you never have to worry about maintenance or scaling infrastructure as you grow.

While we have rolled out a good number of features to early partners, we continue to take feedback and work together with all stakeholders to enhance the user experience and deploy new components.

You can a look at the roadmap for moneykit here, and you can share feedback by sending an email to product@deposits.inc Looking to embed financial services in your app or launch your own fintech proposition to a cohort of users?

Complete this form to get started in our fast-track program, get your app in the hands of real users in 90 days