Welcome to our monthly product update, where you can learn about new features and upcoming releases. It’s been an exciting few months here at Deposits with the team supporting two partners launching their fintech programs and QA giving the green light on the first no-code fintech launch pad and console launch.new

No-code Fintech launch pad

Since April, we have been working on revamping our now legacy developer console. Why retire a good thing you might ask? Because we’re more than just APIs, Deposits offers plug-and-play software as a service for building and hosting fintech applications which are especially meaningful to our partners who have limited baking technology know-how or resources.

For us to meet our mandate to demystify banking and level the playing field, we needed a business-friendly console that also works for developers.

Meet Launch.new the no-code fintech console from deposits.inc - Launch your Fintech program in a few weeks, with the launch console:

- Generate a custom admin back office for your program

- Point and click configuration templates (apps and programs), generate API keys and sandbox environments to test before launch

- Configure brand colors, logo, and features available to each program

- Play with our fintech kits and watch demo videos for popular use-cases built with Deposits

In addition to the friendly user experience (built with the Fintech UIkit), developers can configure back-office URLs, public keys for SDKs, default currency wallets for users, and many more configurations to launch and scale any fintech program.

We’re grateful to our customers and partners, who have contributed so much feedback to this product.

You can learn more about launch.new from this launch video below, or head over to launch.new to get started.

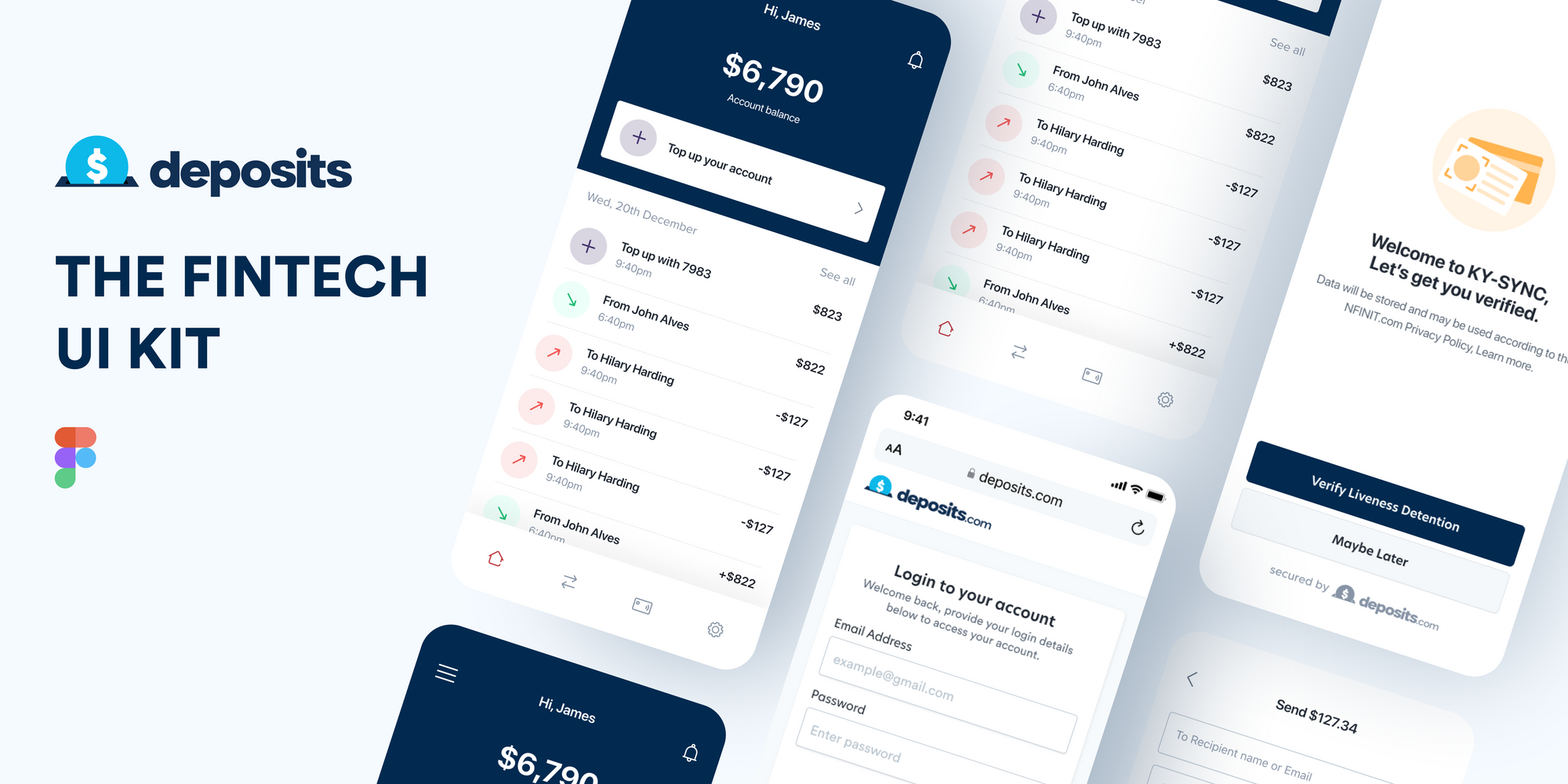

Fintech UIkit

Today, the average consumer expects a great experience interacting with money apps, and banks. The fintech UIkit by Deposits was designed to modernize banking and payments experiences for your users. For most projects - anything from crypto apps, banking apps, e-wallets, personal finance, checkouts, and more, the fintech UIkit is robust enough to enable you to compose modern UI/UX for users.

Designed in Figma and developed in React and VueJs, you will find components for over 90% of your UI requirements. See the video below for a quick introduction and this documentation to get started using the Fintech UIkit by Deposits.

Hosted Payments - One-click

Let’s say you want to collect payments on behalf of merchants using your own brand. The typical time to get the right partner, assemble your team, and implement design and development is 4-8 months. With the one-click-pay from Deposits, time-to-market is 3 days. The one-click payment supports passwordless-login, card tokenization, bank connect/pay with a bank, and digital wallets, boosting conversion rate.

Enabling you to provide fast checkout to customers on behalf of merchants, creating a frictionless experience for customers.

One-click payment SDK is currently available in JS for web and Flutter for mobile. To see it in action, take a look at this Schedule a demo here

Plug and Play Identity verification and onboarding

Time to user value is an important factor in financial services. This is the time it takes a new user to signup and completes the desired action within a banking app or embedded financial service. Today, the fastest financial services have “speed bumps” and for good reason - KYC compliance. KYC, or "Know Your Customer", is the process of identifying and verifying your customer’s identity when an account is opened on your platform.

We built a better way to KYC - Kysync. KySync lets you quickly and effectively reduce fraud on your platform by confirming the identity of every user without friction.

PII is securely collected from each user and verification results are made available to you. And this process can be completed end-to-end without a technical or integration overhead - completely plug and play.

Kysync supports Document verification, Email, and phone validation, biometrics, Address verification, PEP, and more. Schedule a demo here

Upcoming Releases

- Deposits 101 - a quick start guide to all things deposits. Learn the basics of using the Deposits API, console, and backoffice

- No-Code KYB - end-to-end business verification and onboarding

- Commerce SDK - embed lightweight multi-merchant ecommerce anywhere in your platform. With support for card, bank, and wallet payments, product and order management back office for merchants.

- API documentation v2

- Payouts SDK - Enable scalable payouts anywhere - Designed to automate and scale payouts with full visibility and control

- Banking v2 - Our Turn-key SMB digital banking is being updated with more features to deliver more value to your business customers. You can learn more about payments here

- Deposits 101 - a quick start guide to all things deposits. Learn the basics of using the Deposits API, console, and backoffice

- No-Code KYB - end-to-end business verification and onboarding

- Commerce SDK - embed lightweight multi-merchant ecommerce anywhere in your platform. With support for card, bank, and wallet payments, product and order management back office for merchants.

- API documentation v2

- Payouts SDK - Enable scalable payouts anywhere - Designed to automate and scale payouts with full visibility and control

- Banking v2 - Our Turn-key SMB digital banking is being updated with more features to deliver more value to your business customers. You can learn more about payments here