BaaS you dont have to design or code yourself...

Its the 21st century...digital and 3rd party is IN, brick and morter branches are OUT.

Consumers are looking for more than just checking accounts or debit cards. They’re looking for intuitive account opening, easy online borrowing, seamless security, financial wellness tools, and advice—including new ways to save, send money, and make money.

Deposits merges software, payments and banking into an easy to use dashboard with components you dont have to code or design yourself. Our plug-and-play financial technology kits enable any company, bank, or brand to launch and scale fintech in days or weeks, not months and years.

This blog will walk you through how Deposits can help you serve modern financial experiences or build banking into your product.

First lets dive into a few examples of what you can do on the platfrom.

Some use cases include:

- Instant verification for users - KYC/KYB,

- Issuing virtual or physical cards - Debit cards, prepaid debit, credit cards,

- Sending or receiving international payments - FX,

- Issuing receipts and invoices for transactions - Payments,

- Bill payments - Payments

- Credits and loans - Lending

- Loyalty programs - Wallets

- Buy Now Pay Later & Split payments - Payments

- Merchant & E-commerce services - Payments

and much more...

A digital bank requires some key components which we provide - User interface, Bank data aggregation, KYC and PCI compliance, Issuing processor, Bank Sponsor, Fraud protection, General Ledger, etc...

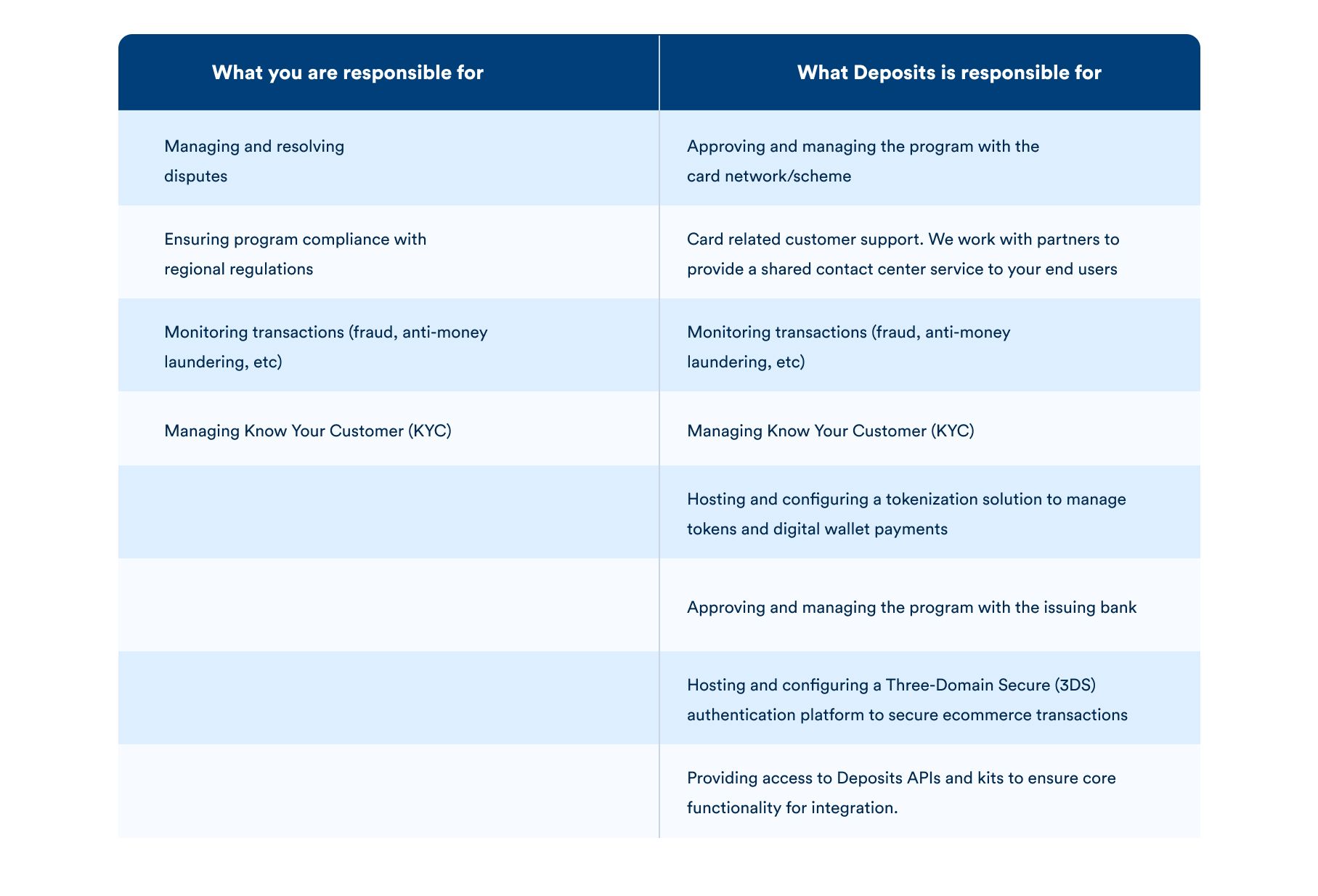

While we cover most of the responsibilities that come with running a digital bank, there are a few responsibilities that falls to you as a tenant, in order to ensure a smooth process and experience for your users.

The steps for launching on Deposits have been broken down into different phases to aid understanding, communication, and go-to-market planning.

CONFIGURATION & COMPLIANCE

Register

This is where you get started, as it requires you to sign up or create an account with Deposits via the Deposits console. Before operating in the Deposits space, you must set up your account on the Deposits console at www.launch.new.

The console exposes you to information about our products and service offerings, answers questions you may have, allows you to play around with our APIs, and even build a mockup if you want.

Due Diligence

Due diligence refers to forms and documents you need to submit to Deposits so we can know your company and have some context about the company, company practices, and overall health. Some things to be submitted include:

- KYB Form

- EFT Authorization Agreement

- Merchant Application

- Brand Authorization

The KYB form is filled and submitted at the point of program creation via the console, while the EFT & brand authorization agreements are sent via mail as the discussion proceeds.

Due diligence must be submitted as soon as possible to avoid any issues or delays, as it must be completed before receiving bank approval.

Discovery Call

You can schedule a discovery call via mail. This is a necessary step for Deposits to determine if your company or idea is qualified to be hosted on the Deposits platform. This enables us to understand what you need and what you want to build and determine if you are the type of customer we need.

After a successful discovery call and agreeing on what is to be built, a Non Disclosure Agreement (NDA) and a Master Service Agreement (MSA) are sent by Deposits. Once this has been signed, a kickoff call is scheduled to get you started.

BETA

Kickoff Call

The kickoff call is a very crucial step in the building on Deposits process as it entails discussions about the following:

- The solution you are building

- Solution overview

- Goals and objectives alignment

- Solutions purchased from Deposits

- Integration milestones

- Project resources

- Pricing

In this call, three Deposits representatives will be assigned to your project to hold your hands through the 90 days of building. We provide you with:

- A technical product manager

- A business partner

- A developer

These representatives are provided to aid correspondence across both our teams and yours. They also answer questions and provide support for your team for the next 90 days.

Invite to Slack support

After the kickoff call, your team will be invited to the Deposits Slack, where a shared channel will be created for your team and the Deposits representatives to interact.

Via this channel, support is made available to your team 24/7 for three months. This channel will be open to representatives from your team and the Deposits representatives you were provided with.

Build

At this point, you can go ahead to build on the Deposits platform. While your solution is not live, as it is in Sandbox, you can carry out various transactions, test endpoints and develop your app on the go.

It is also important to have signed and submitted due diligence to get bank approvals from our partner bank.

If you are offering card services to your users, you will be required to submit a card design.

Program reviews

This is where we check what you have built to ensure it is indeed what you wanted to build. This checks that your program/solution aligns with what was mentioned earlier and the agreements signed.

Sign Beta acknowledgment

While in Beta, we ask that you clearly disclose to your users that your product is still in Beta. This is helpful if there are regulatory inquiries while you are in Beta.

LIVE

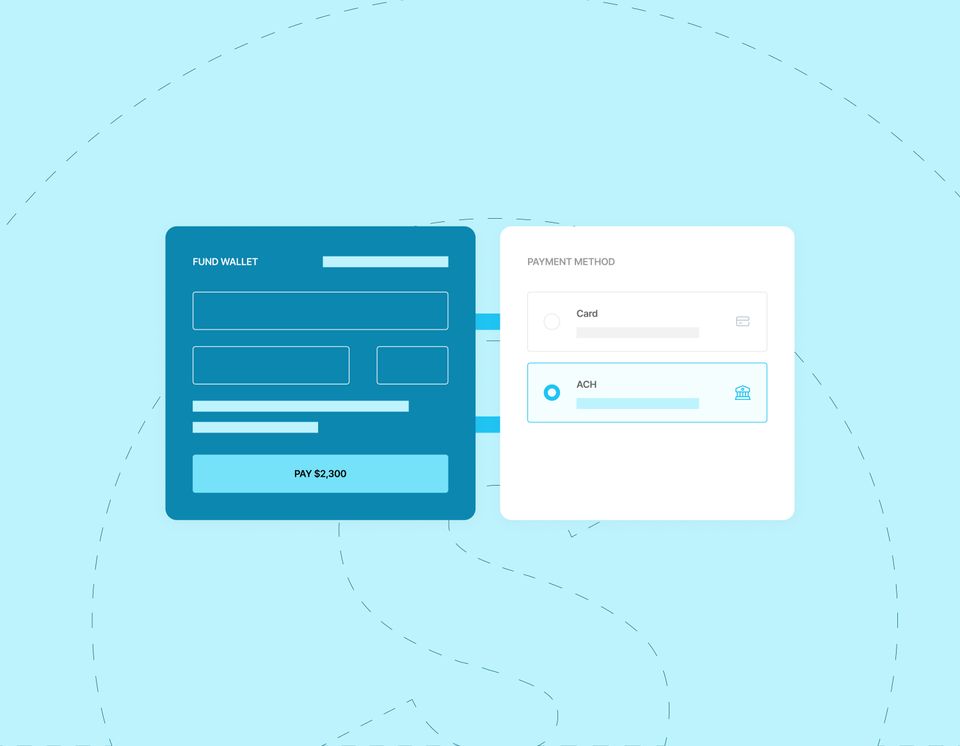

Fund reserve account

After undergoing a program review, you will be required to fund your reserve account.

A reserve account is a master wallet that stores value and funds programs, including products, plans, wallets, deposit accounts, entities, cards and contacts. Program admins must link a funding source or fund the master wallet via wire or ACH. Funds in this account may be used for horizontal (book) transfers or vertical (top-down) transfers such as debiting a user and crediting the master wallet or debiting the master wallet and crediting value to one or many wallets/cards/or contacts etc.

User Acceptance Testing (UAT)

Both Deposits and you carry out User Acceptance Testing. This is for us to check for any misinformation, compliance, alignment with internal compliance and even KYC.

This test is carried out before you go live to review and ensure everything is in order.

Receive live keys

We are prepared to move you to production as soon as you are ready and have had a successful UAT. What this means is that you will receive your love keys, and the user limit cap will be removed to enable you to have as many users as you want.

At this point, your solution has been built, has passed through program reviews, UAT and is now ready to be released to the world.

Go Live!

You are now ready to share your solution with the world!