The API architecture of Deposits is structured into several tiers — Tenants, Entities, Individuals, and, Businesses.

When you use the Deposits infrastructure for your product, you become a tenant, and as a tenant, you manage entities. An entity is a Deposits platform object that may perform transactions. Individuals and Businesses are the two types of entities.

In the fintech industry, KYC and compliance are extremely important. As a Deposits tenant, we recommend using KySync – the Deposits identity verification platform — a comprehensive solution for onboarding, verifying your users, and managing continuous compliance.

How to create a user on Deposits

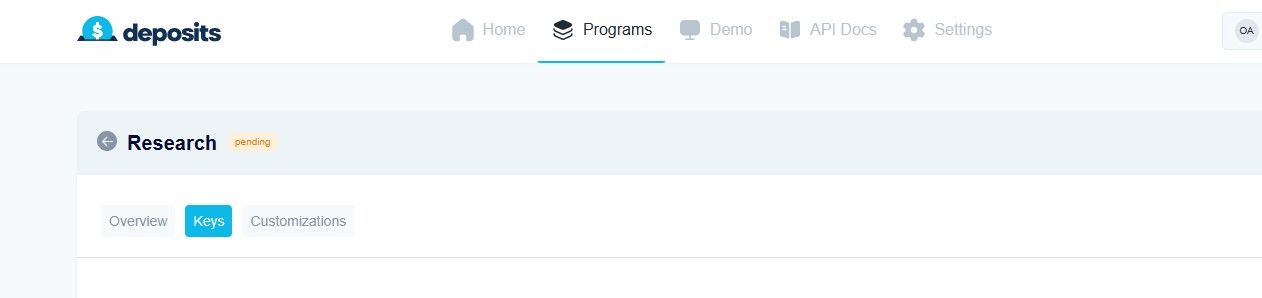

To get started, log in to the console and obtain your API key.

Create a new client and wait for it to be approved. In the sandbox environment, client verification takes a few minutes as it is automatically approved. However, in the production environment, client approval is handled by our compliance team.

After creating a client, navigate to the “keys” section to obtain your API key. It is important to keep your API key private because it provides direct access to your account. Your API key should not be disclosed on public platforms and should be kept safe at all times.

We can use the reference to create a user (Individual entity) using POSTMAN now that we have the API key.

The parameters required to create a user on Deposits can be found in the documentation.

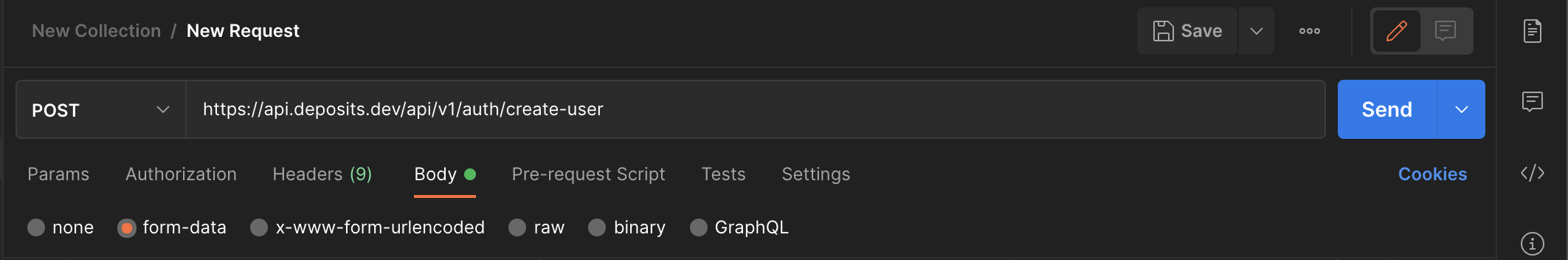

You can use Postman to make a request to the create user endpoint in order to create the test user. Select "form-data" from the menu in the request body.

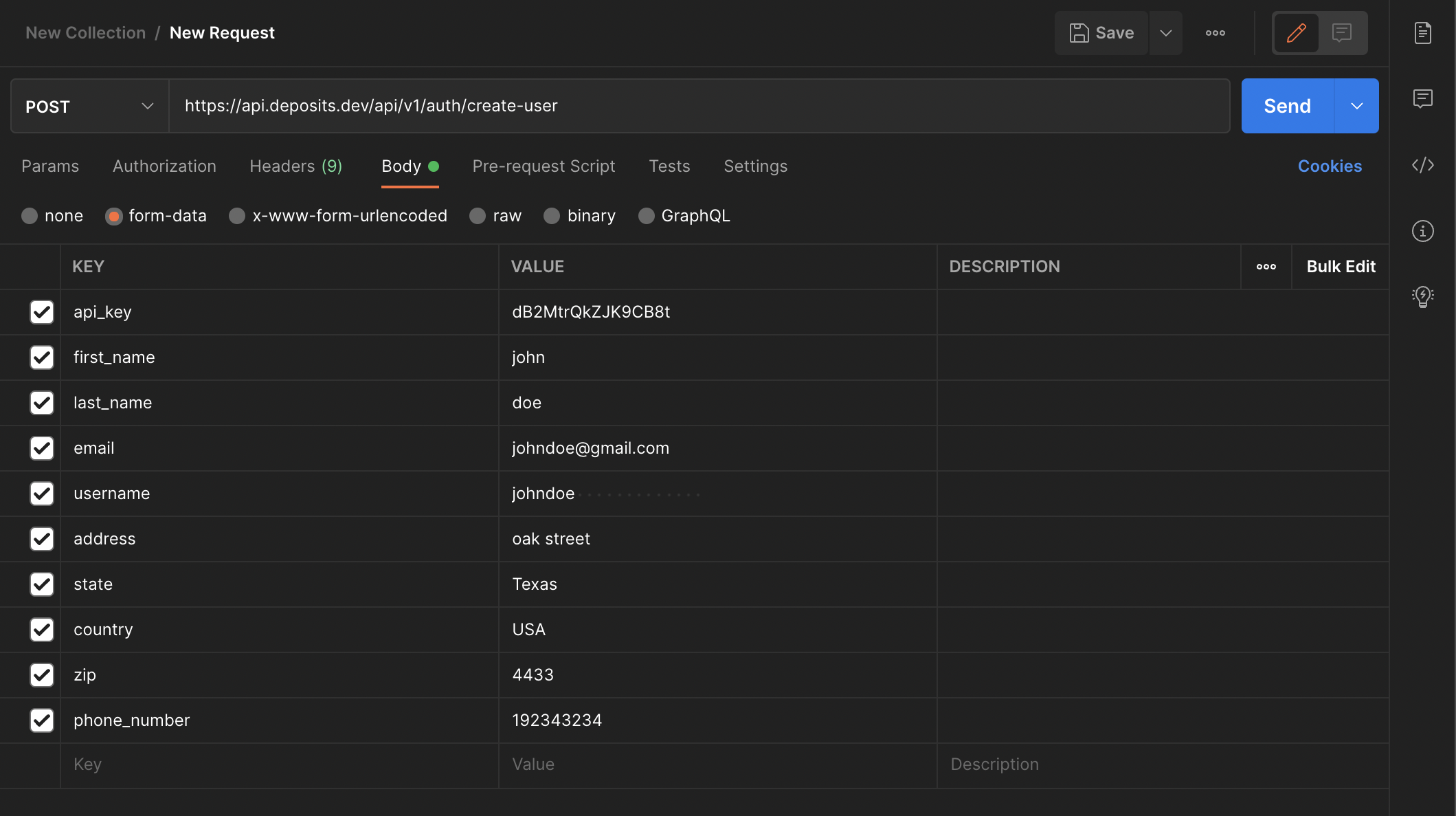

Enter the required parameters as a key-value pair, as provided in the documentation, then submit the request using the send button.

This request will return a JSON-formatted response. The status of the request, a message, and data are all included in our API responses. So, if you sent the request successfully, you should get a response like this:

You can return to the console and navigate to users to see the user we just created after receiving a success message on POSTMAN.

After you've created a user, you can use their user id to perform and record test operations and transactions.

Verifying a User on Deposits

There are different methods for using KySync to verify users on deposits — using the web app, mobile app, and API. The web and mobile apps have made it easy for financial institutions to conduct KYC without writing code. Using the API, there are two steps involved in verifying a user;

- Creating an individual,

- Verifying the individual.

When you create an individual, the user’s details are stored in a “customer_id” variable, which is used for the verification.

Environments

You can access the KySync APIs from the base URLs depending on the stage of development you're in, for easy development and testing.

| Environment | Purpose | Base URLs |

|---|---|---|

| Staging | This environment is used for development and testing only. You can get access to all API endpoints using the test API key associated with your account. | https://api.kysync.deposits.dev |

| Production | This environment is dedicated to live apps and real-time interfaces with our services. It can be accessed using the live API key connected with your account. | https://api.kysync.deposits.com/ |

Create an Individual

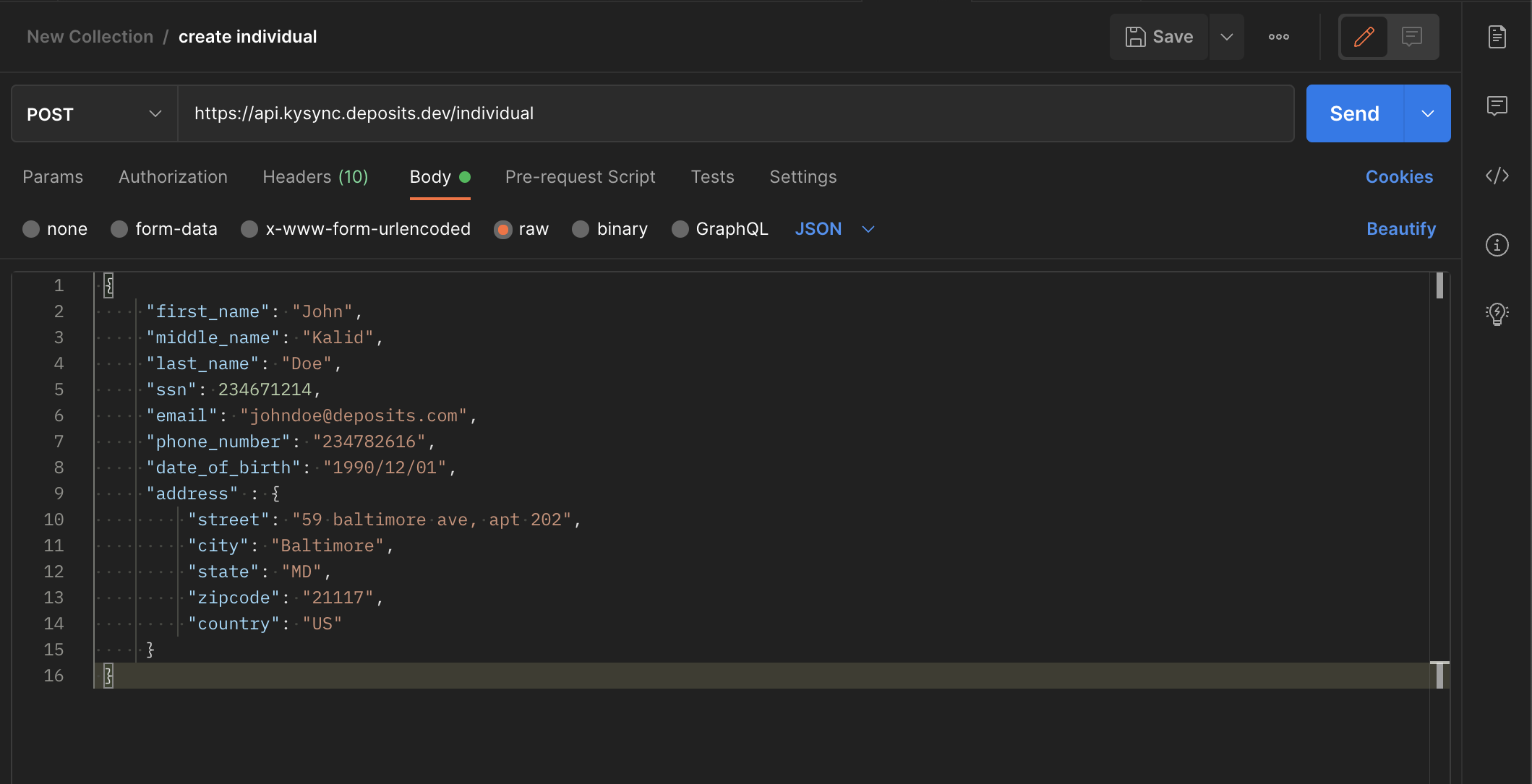

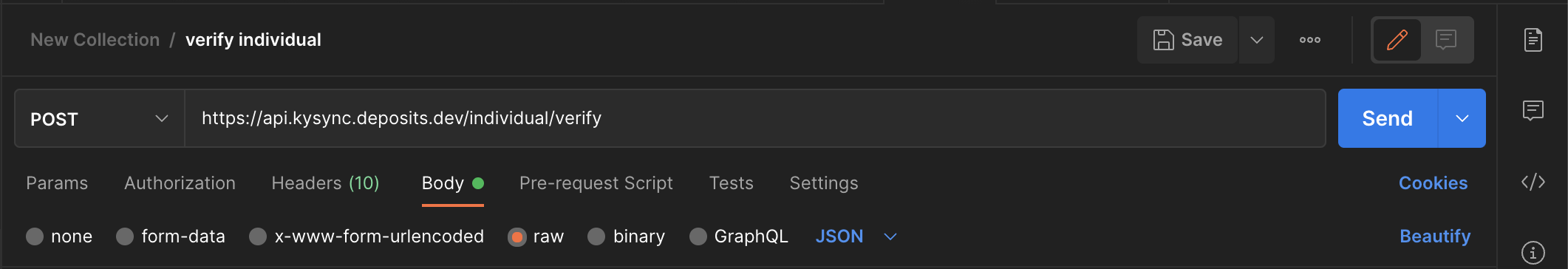

For instance, let’s create an individual using the sandbox environment. To proceed, create a request to the create individual API using Postman to create the individual. In the request body, select "raw" from the menu, and choose JSON.

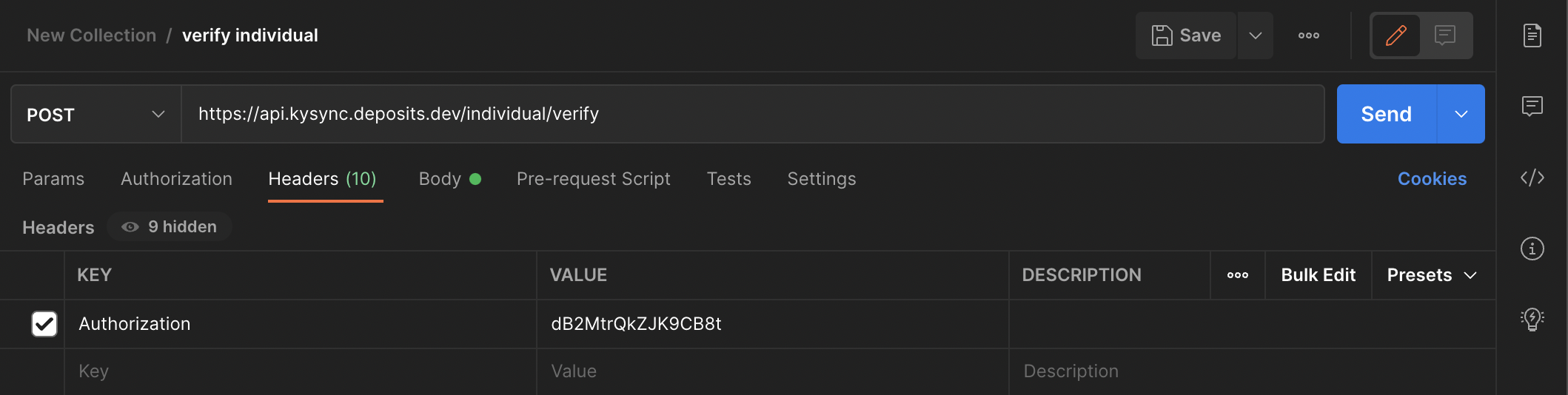

Enter the required parameters in JSON format, as provided in the documentation, then set the authorization key in the header.

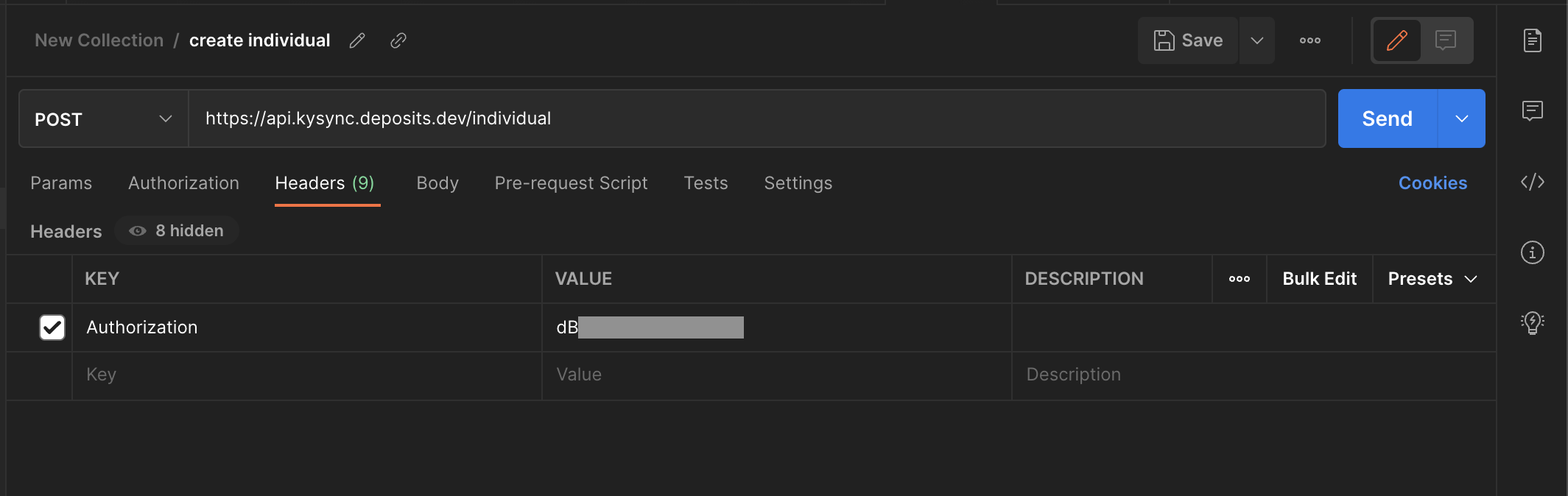

To configure authentication, go to "headers" and add your api key from the Deposits staging console as a key-value pair with Authorization as the key.

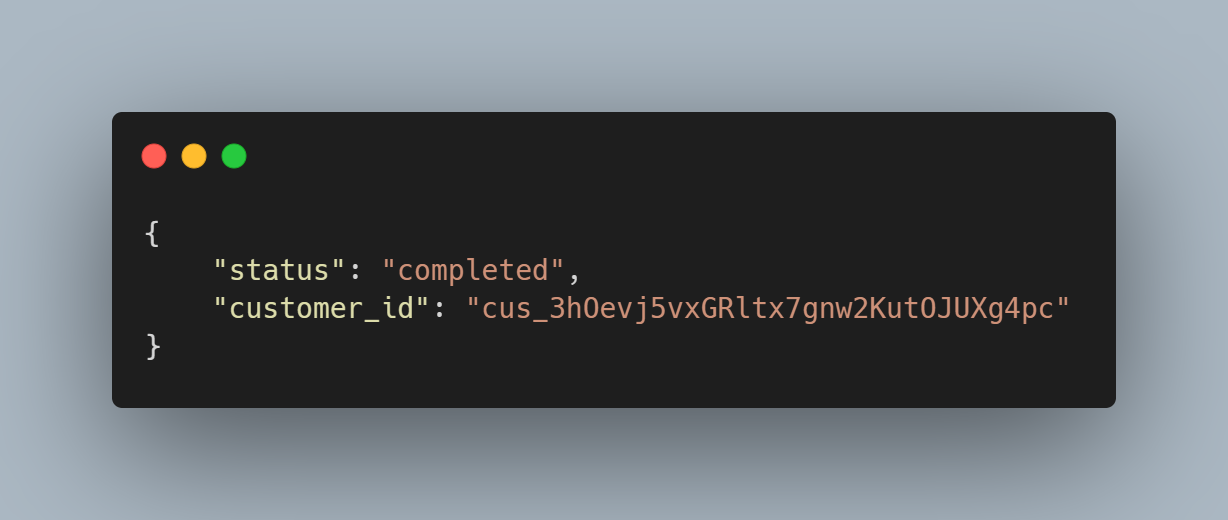

With authentication and request body all set up, you can make the request to the API by clicking the send button. A JSON-formatted response will be returned in response to this request. Our API answers comprise the status of the request, a message, and data(if needed). If your request was successful, you should receive a response similar to this:

Verify an Individual

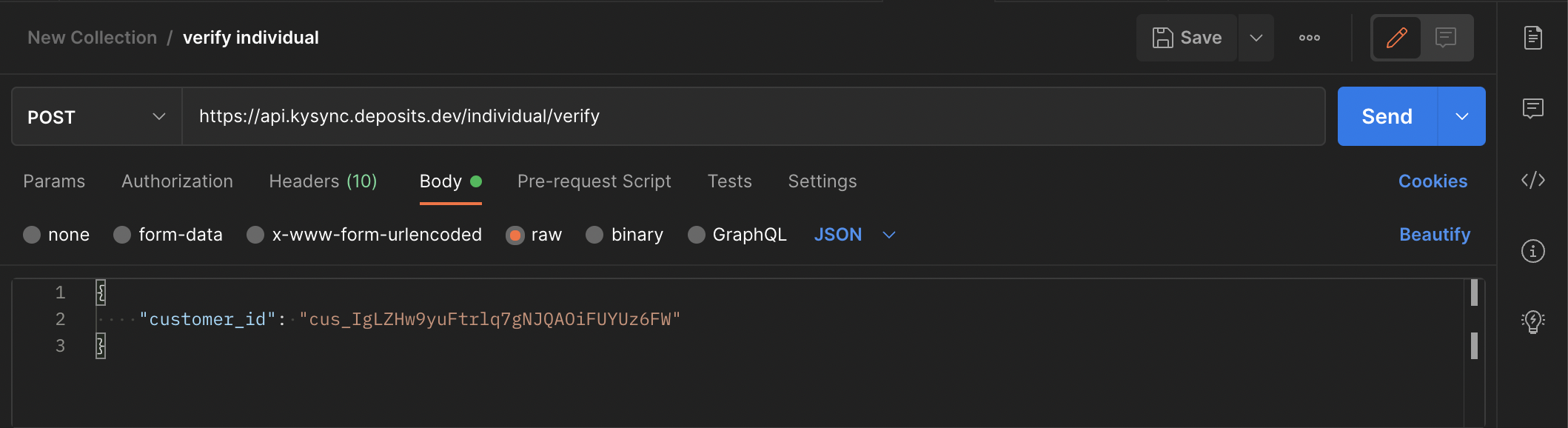

Using the “customer_id”, we can now verify the individual. Just like we did before, on Postman, create a new request using the verify an individual endpoint. Select "raw" from the menu in the request body, then JSON.

To set up authentication, go to "headers" and add your Deposits staging console api key as a key-value pair with Authorization as the key.

Enter the required parameters in JSON format, as provided in the documentation, then make the request by using the send button.

In response to this request, a JSON-formatted response will be returned. If your request was successful, you should receive a response that looks something like this:

Conclusion

There's a lot more you can achieve with the Deposits API if you take the same approach. You can manage and record every transaction that a user has made as long as you have their user id. Deposits provides everything you'll need to build, launch, and scale your Fintech startup.