TX is a startup that wants to build a fintech solution that solves a major problem in the financial world without having to spend a lot of time on development. With X's implementation and our kits, we've conceived a fantastic product.

As the most welcoming home for money, our products are simple and turnkey so you can launch and scale fintech faster.

In this article, we’ll walk you through everything you need to know about building payments and banking with kits from Deposits.

What do you get from Deposits?

Deposits offers a platform on which businesses and developers can build and access financial operations like user data verification, card issuance, virtual banking, and more.

Building with Deposits, you can launch your own fintech solutions. Some use cases include;

- Instant verification for users,

- Virtual or physical cards,

- Sending or receiving international payments,

- Issuing receipts and invoices for transactions,

- Buy Now Pay Later & Split payments,

- Merchant & E-commerce services,

- Bill payments,

- Credits and loans,

- Loyalty programs,

and much more.

The Fintech Kits

Our products are categorized into four main kits. We have SDKs and easy-to-use products to go along with our API that allow you to launch, run, and scale payments with little or no code. These kits include the following:

Identity kit:

For Banking, Payments, and the Consumer Experience, frictionless identity verification is essential. Our identity kit provides no-code KYC for individuals and businesses, continuous compliance, and more.

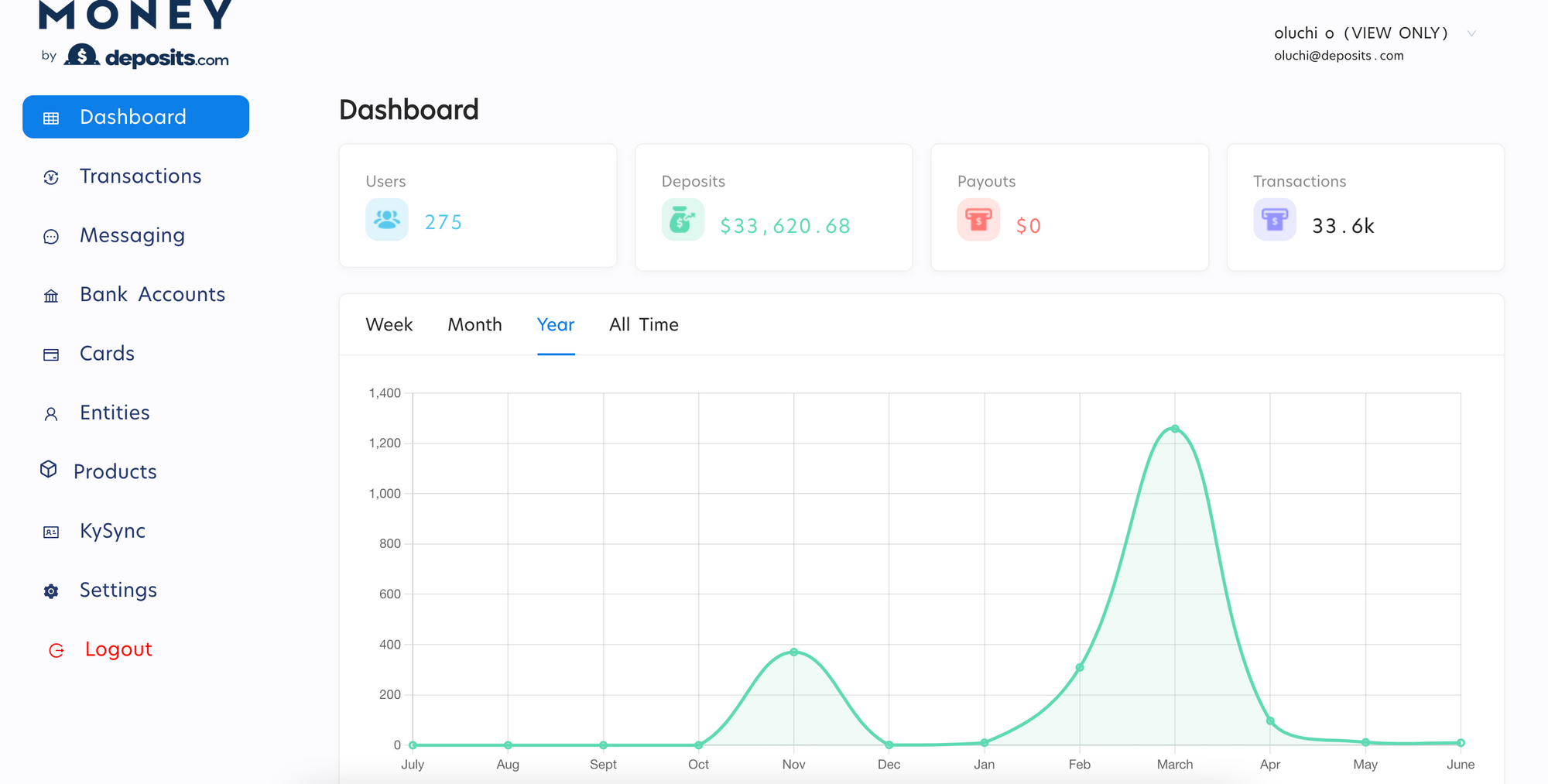

Money kit:

Debit/Credit card programs, Automated savings, Digital wallets, Earned wage access programs, International remittance, and P2P Transfers. We offer turn-key solutions and APIs to power most personal finance use-cases for your community

Banking kit:

No-code digital banking, Online account opening, Corporate spend management, Automated payouts, and Accounts receivable(AR) / Accounts payable (AP) automation. Bank your community or embed banking into your existing product. Banking kit from Deposits empowers you to provide financial services tailored to your community, niche, or users.

Commerce kit:

Integrate e-commerce services into your product using low-code. Enable commerce anywhere covering engaging use-cases like subscription payments, one-click-checkout, Multi-merchant marketplace, Fan Interaction, BNPL, etc.

Building with Low/No-Code

With the introduction of low-code or no-code platforms, developing applications has never been easier. According to Gartner, the worldwide low-code development technologies market is projected to total $13.8 billion in 2021, an increase of 22.6% from 2020.

Building a modern fintech platform requires a multitude of partnerships and integrations, including compliance rules to keep up with. Beyond just APIs to simplify building your Fintech, Deposits provides no-code tools and low-code SDKs to get you started and scaling.

A low-code tool by definition is a software development approach that requires little to no coding in the application development process.

An amazing illustration is our Backoffice, which allows you to manage all of your entities. After developing your application with our APIs or SDK, you may need to work on a backend to manage your users as a Deposits tenant. Rather, you can use our Backoffice, which requires no coding; simply plug and play.

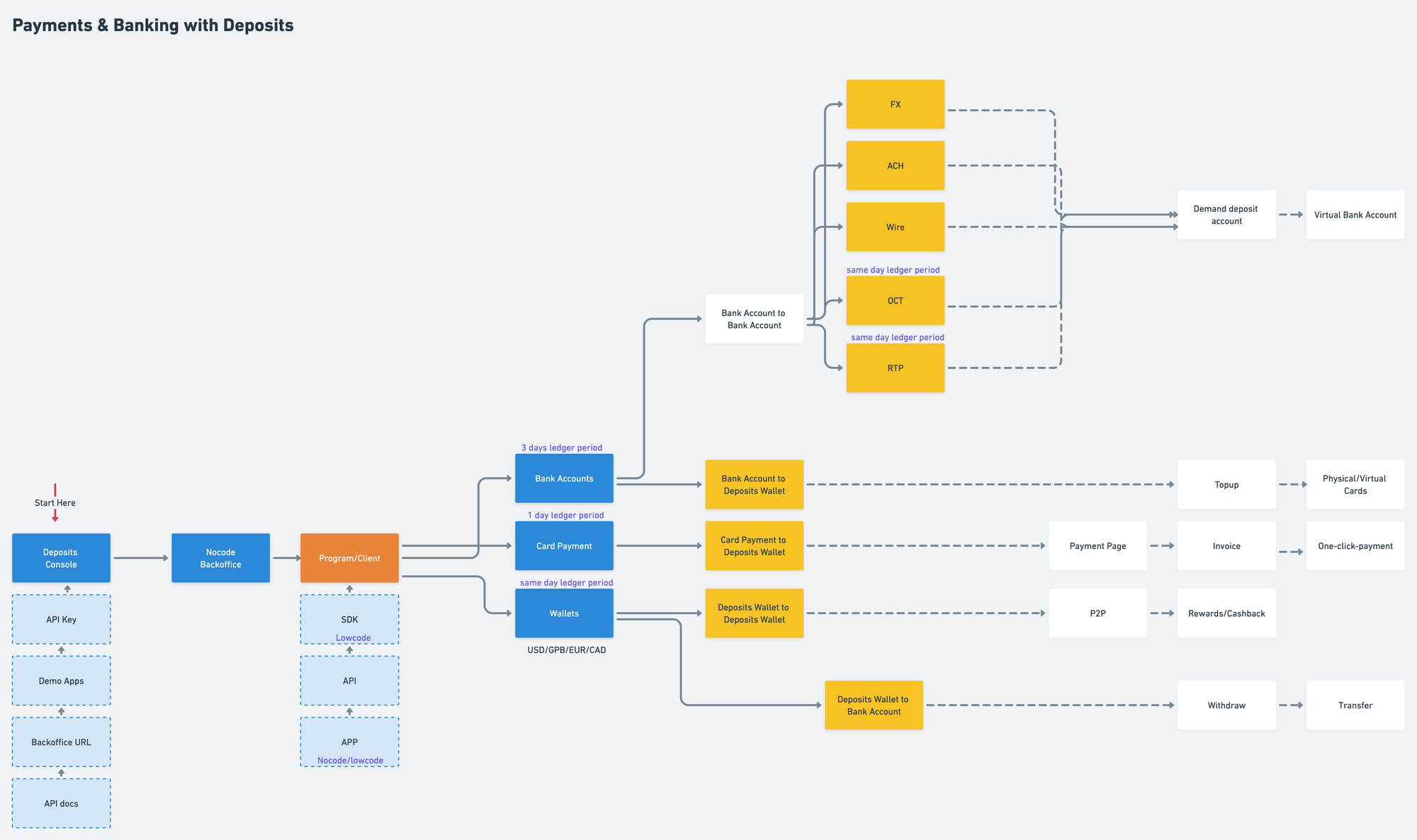

Payments and Payouts

The Deposits infrastructure supports a wide variety of payment options such as card payments, invoices, payment pages, and recurring payments, across a wide range of countries. Our payment processors handle all of the underlying operations that enable businesses to accept payment from retailers, banks, and credit card providers.

It's critical that security and compliance are risk-free and handled with care when it comes to collecting payments. Using the Deposits infrastructure, you'll access all you need to secure legal compliance and payment security.

Deposits will make a payout to the destination account when you want to move money from your Deposits account, wallet, or sub-wallet to an ACH, wire, or bank account. On Deposits, payouts are categorized as Scheduled payouts or Standard payouts.

Scheduled payouts allow you to set up a payout to one or more bank accounts for a specific day or time. This is a great way to pay bills or tackle payroll. Standard payouts, on the other hand, are handled differently depending on the sort of payment method used. For instance, wires, OCT and RTP occur instantly or same day, and ACH payments can take up to 3 days to settle.

Wires and ACH Payments

You can move money across borders and between currencies through wire transfers. Wire transfers are widely used for overseas payments, but they are also available for domestic transactions. ACH allows for the built-in transfer of funds between banks, especially in the U.S.

We offer two settlement types for ACH transactions: Same-day and Standard ACH Settlements. Payouts will not be handled until the next business day after certain hours on a business day. Cut-off times are what they're called. The type of transaction has an influence on the cutoff times.

If a payout is initiated before the cutoff time for same-day settlements, the funds will arrive at the recipient bank the same business day. Whereas, the recipient bank receives standard ACH settlements within 3 - 5 business days.

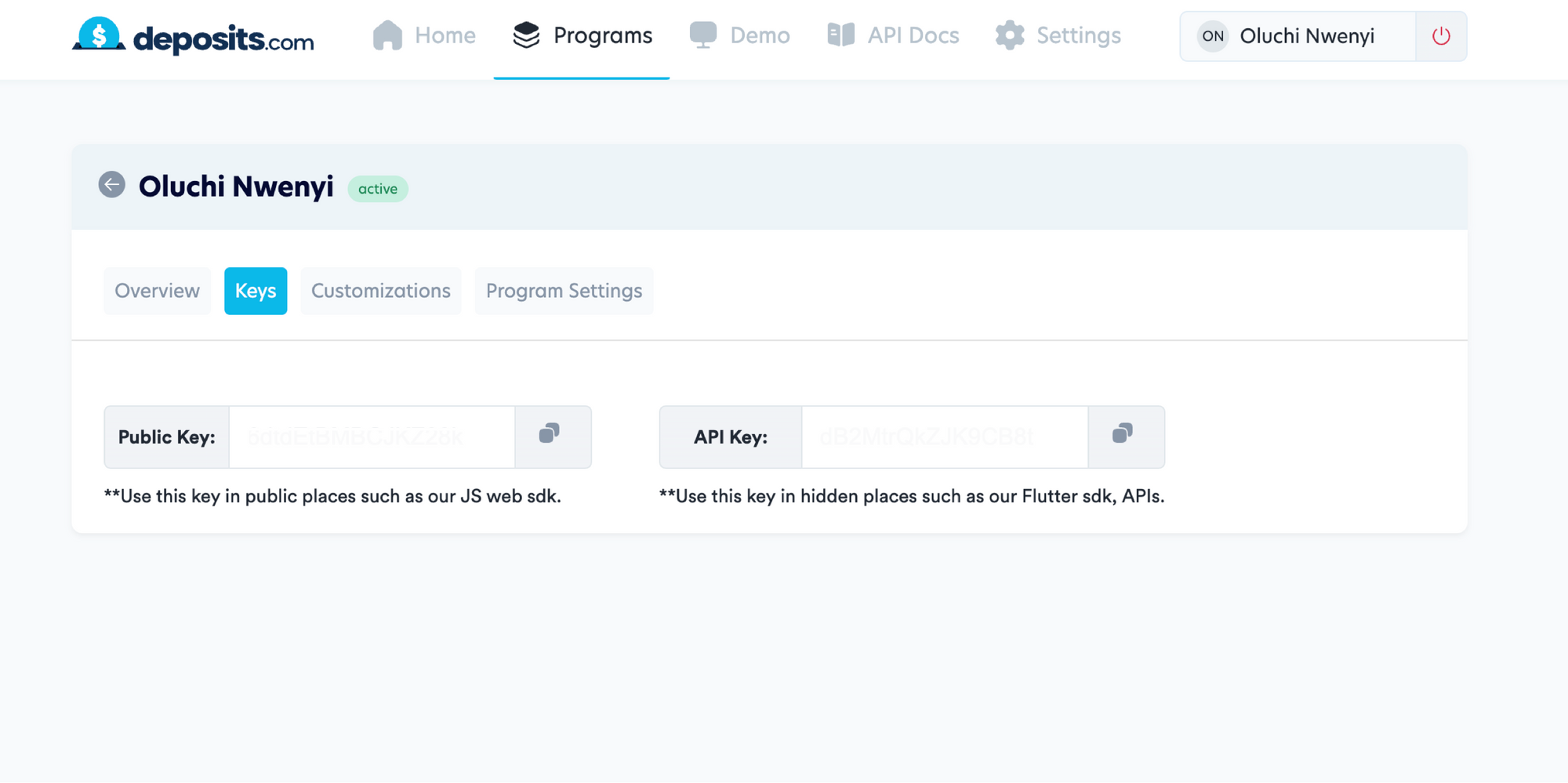

Getting started with Deposits

You don’t have to be a payments expert to build with Deposits. Our Infrastructure is built on a standard REST architecture that returns data in JSON format, and makes use of HTTP request methods and responses.

As a security measure and to make building easier, we have separated our sandbox and production environments. Using the sandbox environment, you can perform all operations using our APIs without moving real money.

To start building on deposits, you can create a sandbox account to access the console and retrieve your authentication keys.

Using Deposits API Reference

Our documentation is an excellent resource that supports you when implementing your Deposits-based solution. Because of its structure, the API documentation and guides are easily found in their directories and sections.

For each endpoint, you can retrieve all the details, including methods, parameters, and answers. You can start with creating a user on Deposits to try it out.

Conclusion

Our kits make it simple to launch any payments and banking use case that works for your community or customers and is tailored to your brand. You will save both time and money by doing so. It's time to get started with Deposits now that you have all you need to build, launch and scale Fintech.