The first generation of embedded finance companies unquestionably disrupted the status quo and laid important groundwork for the modernization of finance. But because the technical requirements of the first wave of solutions could only be met by large organizations, not everyone has yet had an opportunity to share in the innovation.

Today, not everyone can bank on their phone, or get a loan through an app, or get approved for a new home in minutes. Fintech hasn’t solved the inclusion problem but the next generation of embedded finance will.

At Deposits, in an impressively short amount of time, we have built, validated and refined a product that tears down technical barriers – so that we can do the same with financial barriers. We’ve broken down the value chain horizontally, leveraging existing distribution channels to provide access to financial services at lower costs, with greater personalization, engagement, onboarding, and discovery.

It’s my belief that financial solutions for community verticals are best developed by community members. We’re thrilled to be at the forefront of this revolution, enabling a future where non-developers can deliver tailored, contextual financial services.

With Deposits, all it takes is a trusted relationship to deliver best in class financial services. Deposits’ plug and play no-code banking-as-a-service (BaaS) platform makes it simple for small banks, credit unions, and other brands that consumers trust to deliver modern financial experiences to their communities. They can quickly roll out services like mobile apps, fully online account opening, identity verification, debit and credit accounts, mobile deposits, virtual cards, P2P payments, home and auto loans, foreign exchange and more.

With the advance of fintech and the rapid adoption of mobile finance, we share an enormous opportunity – and responsibility – to open access to more sophisticated financial services that will help people in each and every community build wealth.

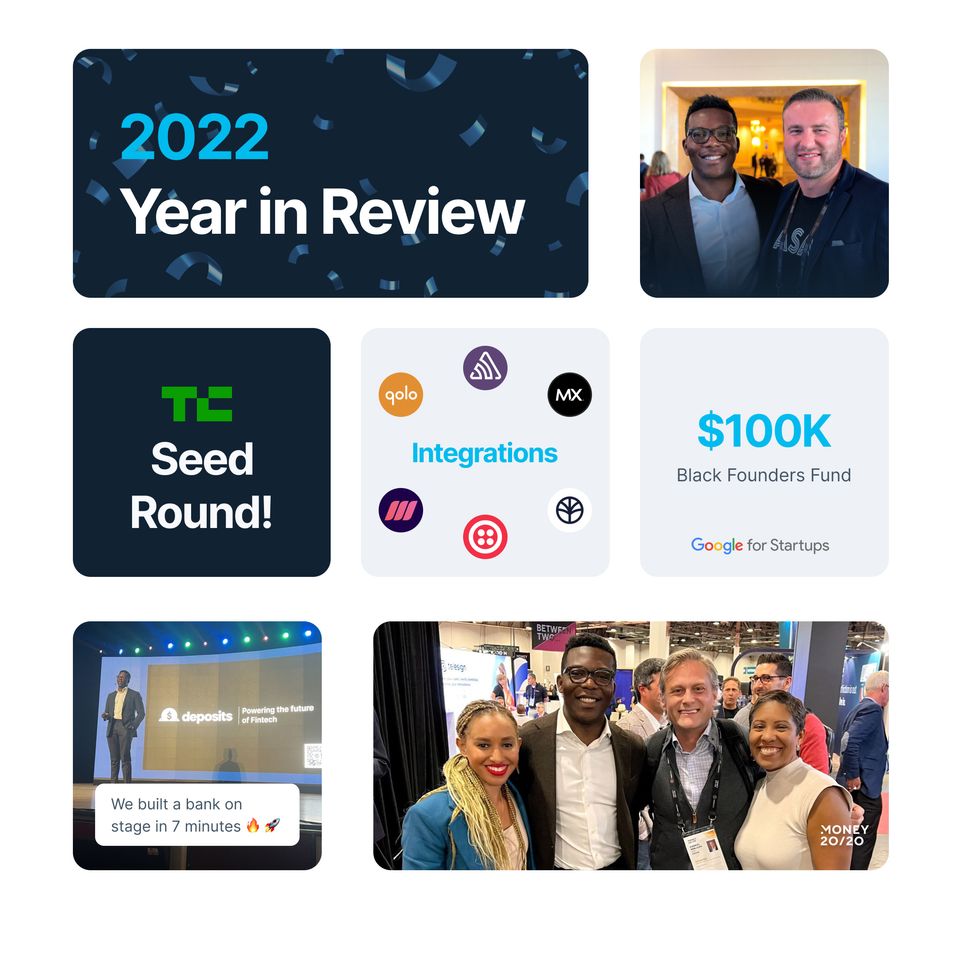

That’s why I’m not only proud of the work our team has done so far, but I’m also particularly energized to announce that Deposits has completed a $5 million seed round led by ATX Ventures and joined by Cabal Fund, Lightspeed Venture Partners, and others. This funding will be used to scale operations, infrastructure, and to build out additional services to offer on the Deposits platform.

From here, we only move faster, and innovate more for community banks, community credit unions and community focused financial brands and I’m excited to do it together with you.

I’d like to give a special thank you to my wife who has supported me and allowed me to work like a madman. To my parents who gave me the gift of education and confidence to pursue my dreams. To my team of underdogs who have banded together to build something of global significance and great value. To my mentors, who have helped me hone my communication skills. To my Investors who have entrusted me with their resources. To my friends and family for their support and encouragement. And to God, through which all things are possible. I’m truly grateful for the opportunity to do good work and take our shot at changing the world.